OCO Orders (One Cancels Other)

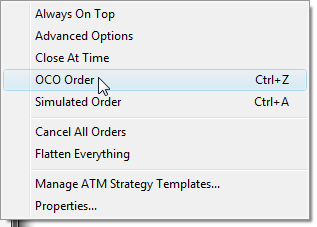

Stop Loss and Profit Target orders (submitted automatically via an ATM Strategy) are always sent as OCO, however, you can submit entry or exit orders as OCO orders as well. Why? The market may be trading in a channel and you wish to sell at resistance or buy at support, whichever comes first by placing two limit orders at either end of the channel. To place OCO orders, press down on your right mouse button inside the Basic Entry window and select the menu name or use the short cut key CTRL+Z.

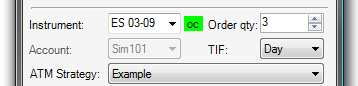

The "oc" (OCO indicator) will light up green. All orders placed while this indicator is lit will be part of the same OCO group. Once any order of this group is either filled or cancelled, all other orders that belong to this group will be cancelled. If you want each OCO order to create it's own set of Stop Loss and Profit Target orders ensure that the ATM Strategy control list is set to either or a strategy template name before you submit each OCO order.

Break Out/Fade Entry Example

One of the great features of NinjaTrader is its ability to submit two entry orders, one of which will cancel if the other is filled.

You can accomplish a breakout/breakdown approach by:

| • | Right clicking in the Basic Entry window and selecting the menu item to enable the OCO function |

| • | For your first order, select the desired option from the "ATM Strategy" drop down list |

| • | Submit your stop order to buy above the market |

| • | For your second order, select the desired option from the "ATM Strategy" drop down list |

| • | Submit your stop order to sell below the market |

| • | CRITICAL: Right click in the Basic Entry window and select the menu item to disable OCO for future orders. |

For a market fade approach just substitute limit orders for stop orders.

|