Volume Profile is a dynamic tool that displays volume-at-price information for order flow traders. While the patterns of Volume Profiles may initially appear random, there are recurring shapes that can potentially provide insight into market direction, support & resistance zones, reversal areas and more.

Below are 4 common Volume Profile shapes and how order flow traders can interpret them.

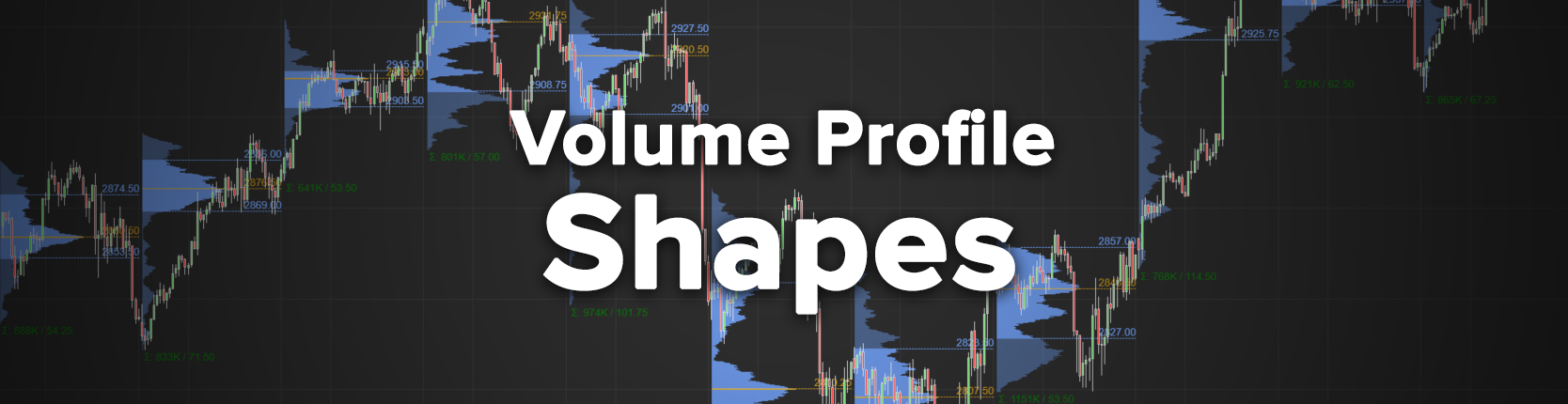

P-Shaped Volume Profile

A P-shaped Volume Profile typically occurs when a market rises sharply and then consolidates. After price reaches the upper end of a P-shaped profile, there can be a period of consolidation where balance is reached between buyers and sellers.

The lower portion of a P-shaped profile is long and thin representing low volume rejection. The wider upper section represents where a “fair” price was reached and trading activity elevated.

While P-shaped profiles often occur during uptrends, a P-shaped profile can also mark the end of a downtrend indicating a possible short covering rally. Since short covering is usually seen as temporary strength within a market, P-shaped profiles can be interpreted as bullish signals.

b-Shaped Volume Profile

A b-shaped Volume Profile forms when a market falls sharply and then consolidates. The opposite of a P-shaped profile, a b-shaped Volume Profile can occur as a result of long liquidation. While P-shaped profiles represent short covering, b-shaped profiles represent a period of selling before balance is found in a market.

The upper portion of a b-shaped profile is long and thin representing low volume and an “unfair” perception of price. The wider bottom section represents where price once again reached a balance between buyers and sellers.

b-shaped profiles are commonly found during downtrends but when a b shape is seen during an uptrend, it can potentially indicate a reversal. Because b-shaped profiles represent longs exiting the market, they are generally understood as bearish signals.

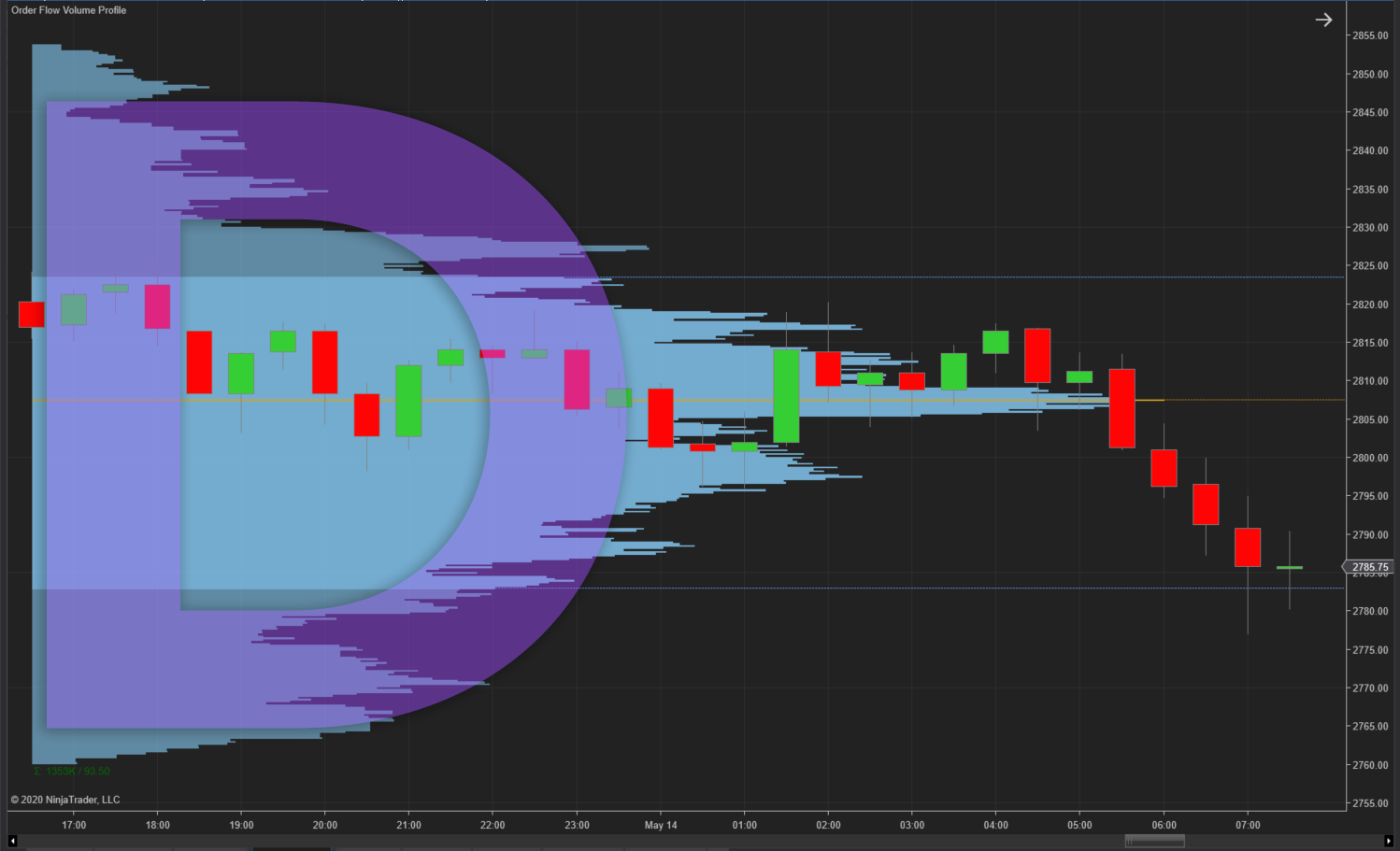

D-Shaped Volume Profile

D-shaped profiles occur when there is a temporary balance in a market. The Point of Control (POC) is typically located in the center of the profile indicating a balance between buyers and sellers.

Some traders might interpret a D-shaped profile as a choppy or sideways market that lacks a clear direction - since neither buyers nor sellers were more aggressive. However, patient order flow traders might seek out D-shaped Volume Profiles in anticipation of a potential breakout in either direction as institutional players build up their positions.

B-Shaped Volume Profile

A B-shaped Volume Profile arises when two D-shaped profiles occur within a specified time period. Although there is only one value area and POC, some order flow traders will separate the profile into 2 separate “D-areas” with their own value areas. This is where NinjaTrader’s Volume Profile Drawing Tool can come in extra handy, plotting custom profiles on the fly.

While B-shaped profiles are generally interpreted as a continuation of a trend, it is important to note which POC is more dominant – indicating whether activity was greatest at the top or bottom of the profile.

Start Using Volume Profile Today

Volume Profile is included with NinjaTrader’s Order Flow + suite of premium technical analysis tools. It features 3 profile modes, 6 display modes and can be applied to charts as both an indicator and drawing tool.

Get Started with NinjaTrader

NinjaTrader supports more than 800,000 traders worldwide with a powerful and user-friendly trading platform, deep discount commissions and world-class support. NinjaTrader is always free to use for advanced charting, strategy backtesting and an immersive sim trading experience.

Download NinjaTrader’s award-winning trading platform and get started with a free trading demo with real-time market data today.