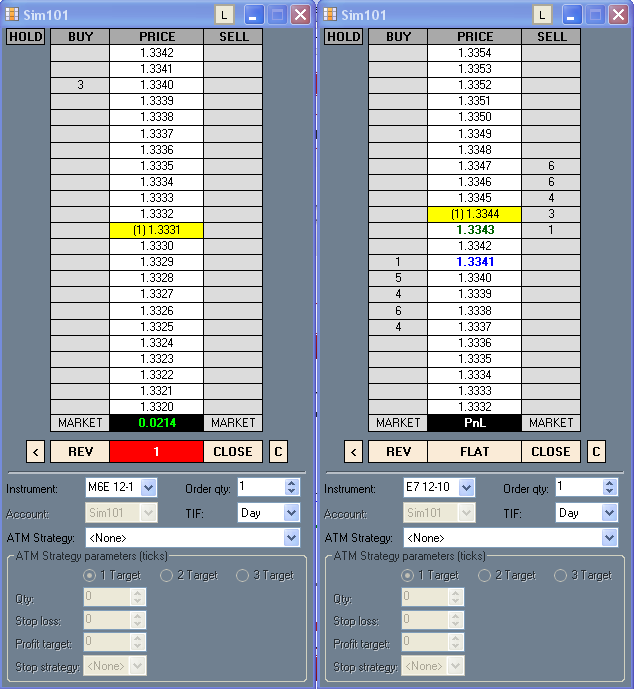

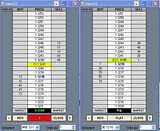

As you can see from the following DOM screen captures (M6E on the left, and E7 on the right) , hugely aberrant behavior can result of the wacky spreads on the M6E and last traded price disparity. Talk about a strategy buster!!!

Note that you can't even see the ask price on M6E on this first shot taken at 5:15:22PM today. The M6E is 13 ticks away from the E7 last traded price. You can't even adjust the DOM to see what is going on here!!!

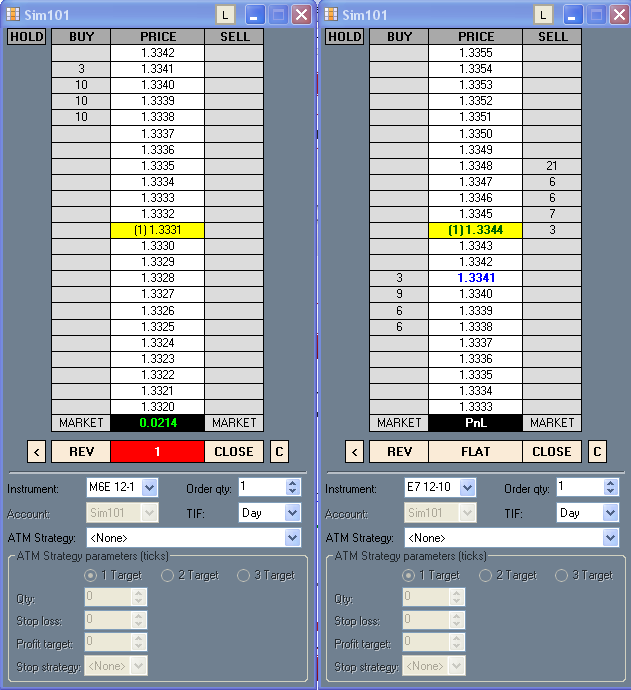

taken at 5:15:56PM today

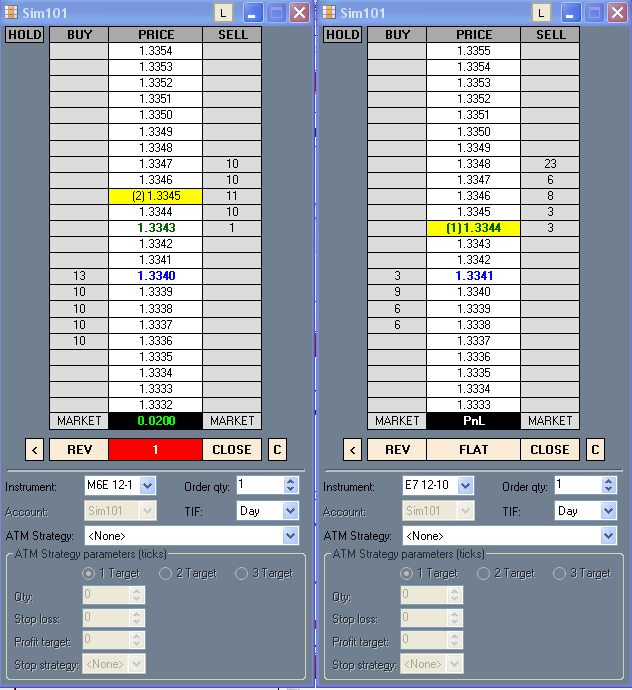

taken at 5:17:15PM today - all of a sudden boom! the LTP jumps 14 ticks! No inbetween ticks, just took a quantum leap higher.

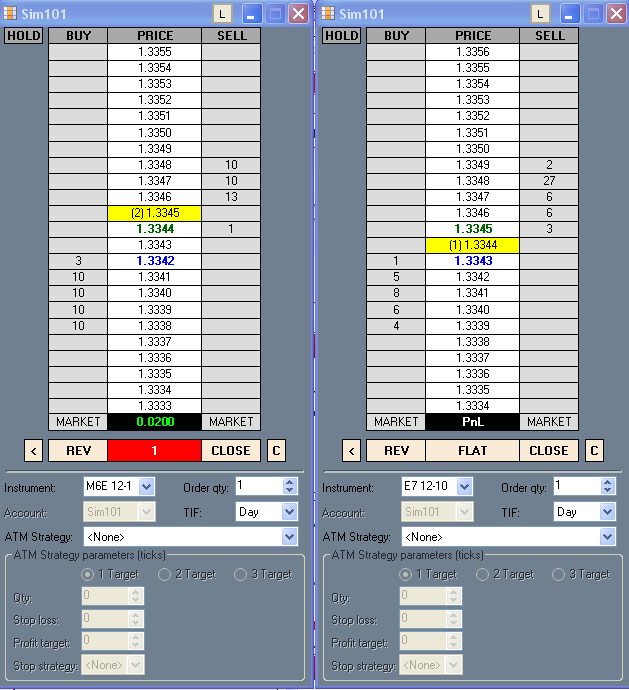

taken at 5:19:12PM today

Is there any way to replay this data on NT7 through my PFG feed? I would record a video of the oddity if I can.

Comment