As someone doing discretionary trading, you would need to extrapolate your system into 3 Categories:

1. A set of trading rules to include ,entry,exit rules.

2. Execution - Order, market, stop, stoplimit. limit etc

3. Trade Management

A. The Trade Signal

1.Trade Entry Rules - conditions for the trade

2.Trade Filter Rules - time ,trend, range, other

3.Trade Exit Rules - technical

Visualization: Think of the Trade Entry as red dot on the chart for a short or green dot on the chart for a long, perhaps the filter as a black dot, the exit a grey dot to make it clear on a chart... + note any external system rules.

Signal Execution

Entry Order Type, Quantity and Price

Position sizing etc

Trade Management

Bracket of StopLoss, Profit Targets

Breakeven

Stop Trail

Time based exits - close before session end

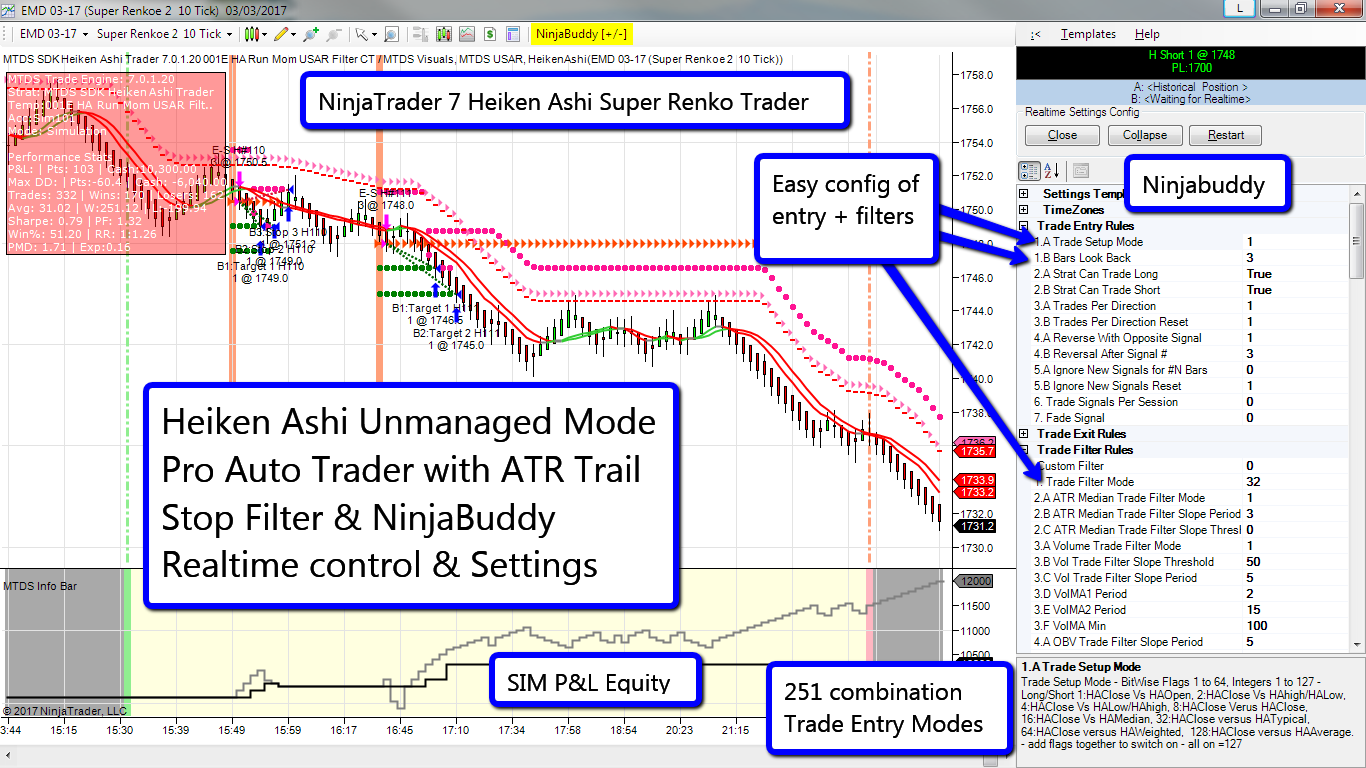

Fully Versus Semi automatic trading with trade management

if your some of or all of your rules are based on experience or hard to quantify or include as code - you will need a system that allows you to interact in real-time and allow auto trading or manual placement... etc so you can use discretion/ semi auto trading with trade management etc

So now you can think in those areas and create all the rules and then use them in a mechanical trading system. But no need to invent the wheel. use a Strategy development kit, so that all the common features requires for trading already exist. Dont pay a developer to re-invent the wheel and charge you 1000s for the privilege. All you need do is define the "Signal part" and the rest would be already developed - Just a a case of configuration.

How to build your own professional NinjaTrader Strategy in Unmanaged Mode for Professional reliability and execution – purpose built for live trading Super Super Charge your Trading Strategies in just a few lines of code

You can in fact use the NinjaTader Strategy Wizard and create the basis Trade Entry Rule - the port them to a professional trading strategy development kit such as the the MTDS7

Which is always free for demo/sim/ development/ backtesting.

Using the MTDS7 would save you 2 yeras of development and 200Kusd in costs such a system if you were able to find someone to develop it and the knowledge:

http://microtrends.co/ninjatrader/ni...velopment-kit/

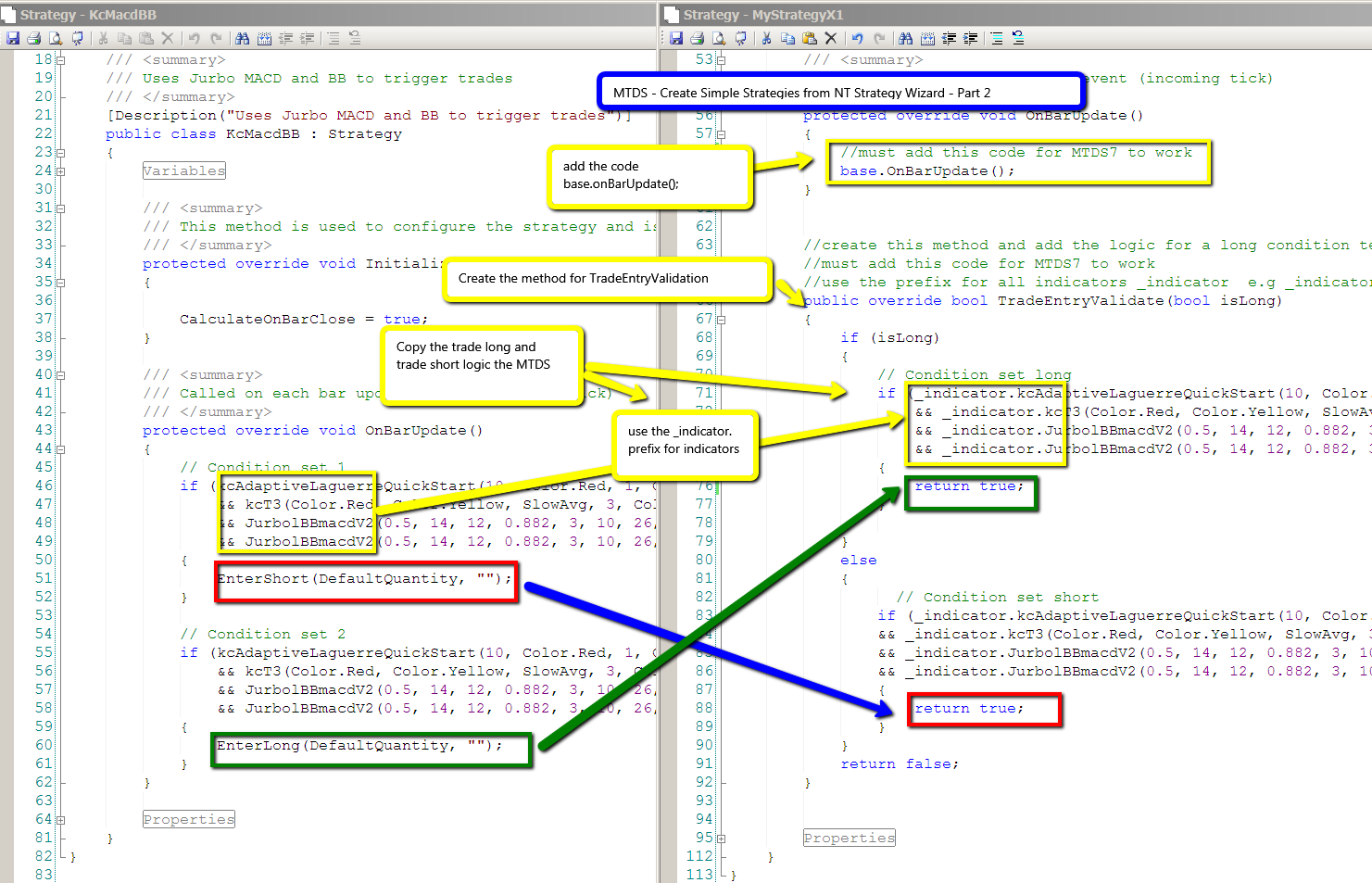

How to port over your code from the Strategy Wizard to MTDS7

Install the NinjaTrader Strategy Development kit

1. run the strategy wizard in NinjaTrader and create your entry rules

2. Open the code script

3. Re-Factor the code with the MTDS7 methods

4. Compile and Run

Rename the base class to inherit all the MTDS7 functionality

Refactor use the MTDS7 Trading code blocks

Comment