https://i.gyazo.com/2c94330120e5ee61...c41550a067.png

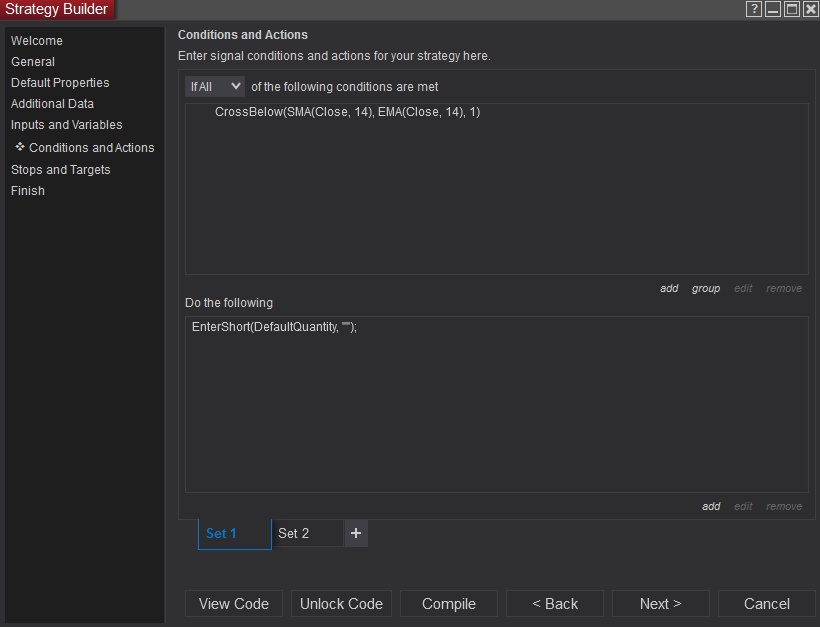

Right now, the way I have it coded, I use a simple EnterLong and EnterShort to essentially "reverse" when the crossover happens:

https://i.gyazo.com/dceb055ff2c91029...b45abd08f8.png

I get this:

https://i.gyazo.com/0ebaa9b8d0ed973d...c1db12c952.png

However it seems like I get a lot of slippage and in general it doesn't seem like it's "Reversing" correctly. Is there a better way to code this in strategy builder? A close position action and then a buy/short action at the same time seems strange and... unelegant? to me.

Also, 2nd mini question: Is there a way to keep my ATM trades marked on the chart and on the control center indefinitely after the end of the day? I come home after the markets close and all my accounts are sitting at 0.00 PnL and I have no markers on my chart to see how my strategy worked. I also have the Tools > Options > Trading > Auto close positions set on for 15:44:00 EST. Could this be why all the markers of entries and exits are disappearing later?

Comment