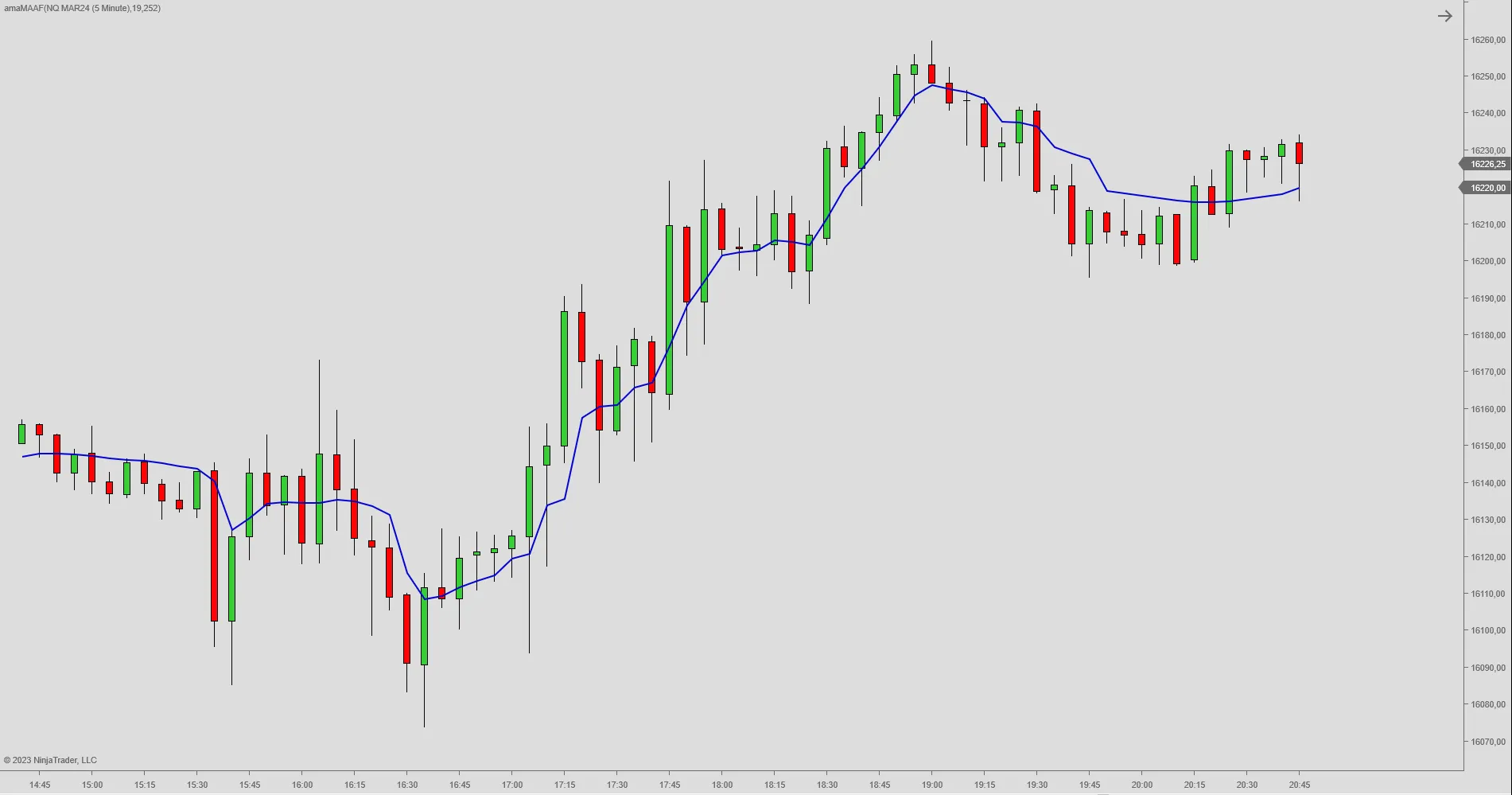

i am trying to code http://www.stockspotter.com/Files/wh...difference.pdf

so far i have coded :

#region Using declarations

using System;

using System.Collections.Generic;

using System.ComponentModel;

using System.ComponentModel.DataAnnotations;

using System.Linq;

using System.Text;

using System.Threading.Tasks;

using System.Windows;

using System.Windows.Input;

using System.Windows.Media;

using System.Xml.Serialization;

using NinjaTrader.Cbi;

using NinjaTrader.Gui;

using NinjaTrader.Gui.Chart;

using NinjaTrader.Gui.SuperDom;

using NinjaTrader.Gui.Tools;

using NinjaTrader.Data;

using NinjaTrader.NinjaScript;

using NinjaTrader.Core.FloatingPoint;

using NinjaTrader.NinjaScript.DrawingTools;

#endregion

//This namespace holds Indicators in this folder and is required. Do not change it.

namespace NinjaTrader.NinjaScript.Indicators

{

public class JEMEDIANAVARAGE2005TASC : Indicator

{

private Series<double> Price;

private Series<double> Smooth;

private double Value0;

private double Value1;

private Series<double> Value2;

private double Value3;

private double alpha;

protected override void OnStateChange()

{

if (State == State.SetDefaults)

{

Description = @"Enter the description for your new custom Indicator here.";

Name = "JEMEDIANAVARAGE2005TASC";

Calculate = Calculate.OnBarClose;

IsOverlay = true;

DisplayInDataBox = true;

DrawOnPricePanel = true;

DrawHorizontalGridLines = true;

DrawVerticalGridLines = true;

PaintPriceMarkers = true;

ScaleJustification = NinjaTrader.Gui.Chart.ScaleJustification.Right;

//Disable this property if your indicator requires custom values that cumulate with each new market data event.

//See Help Guide for additional information.

IsSuspendedWhileInactive = true;

Length = 39;

Threshold = 0.002;

AddPlot(Brushes.DarkKhaki, "JEFilt");

}

else if (State == State.Configure)

{

}

}

protected override void OnBarUpdate()

{

//Add your custom indicator logic here.

/* Inputs: Price((H+L)/2),

Threshold(.002);

Vars: Smooth(0),

Length(30),

alpha(0),

Filt(0);

Smooth = (Price + 2*Price[1] + 2*Price[2] + Price[3]) / 6;

Length = 39;

Value3 = .2;

While Value3 > Threshold begin

alpha = 2 / (Length + 1);

Value1 = Median(Smooth, Length);

Value2 = alpha*Smooth + (1 - alpha)*Value2[1];

If Value1 <> 0 then Value3 = AbsValue(Value1 - Value2) / Value1;

Length = Length - 2;

End;

If Length < 3 then Length = 3;

alpha = 2 / (Length + 1);

Filt = alpha*Smooth + (1 - alpha)*Filt[1];

Plot1(Filt);*/

Price[0]=(High[0]+Low[0])/2;

Value3 = 0.2;

Smooth[0] = (Price[0] + 2*Price[1] + 2*Price[2] + Price[3]) / 6;

while (Value3 > Threshold)

{

alpha = 2 / (Length + 1);

Value1 = Median(Smooth, Length)[0];

Value2[0] = alpha*Smooth[0] + (1 - alpha)*Value2[1];

if( Value1 != 0)

{

Value3 = Abs(Value1 - Value2[0]) / Value1;

}

Length = Length - 2;

}

}

#region Properties

[NinjaScriptProperty]

[Range(1, double.MaxValue)]

[Display(Name="Length", Order=1, GroupName="Parameters")]

public double Length

{ get; set; }

[NinjaScriptProperty]

[Range(1E-05, double.MaxValue)]

[Display(Name="Threshold", Order=2, GroupName="Parameters")]

public double Threshold

{ get; set; }

[Browsable(false)]

[XmlIgnore]

public Series<double> JEFilt

{

get { return Values[0]; }

}

#endregion

}

}

#region NinjaScript generated code. Neither change nor remove.

namespace NinjaTrader.NinjaScript.Indicators

{

public partial class Indicator : NinjaTrader.Gui.NinjaScript.IndicatorRenderBase

{

private JEMEDIANAVARAGE2005TASC[] cacheJEMEDIANAVARAGE2005TASC;

public JEMEDIANAVARAGE2005TASC JEMEDIANAVARAGE2005TASC(double length, double threshold)

{

return JEMEDIANAVARAGE2005TASC(Input, length, threshold);

}

public JEMEDIANAVARAGE2005TASC JEMEDIANAVARAGE2005TASC(ISeries<double> input, double length, double threshold)

{

if (cacheJEMEDIANAVARAGE2005TASC != null)

for (int idx = 0; idx < cacheJEMEDIANAVARAGE2005TASC.Length; idx++)

if (cacheJEMEDIANAVARAGE2005TASC[idx] != null && cacheJEMEDIANAVARAGE2005TASC[idx].Length == length && cacheJEMEDIANAVARAGE2005TASC[idx].Threshold == threshold && cacheJEMEDIANAVARAGE2005TASC[idx].EqualsInput(input))

return cacheJEMEDIANAVARAGE2005TASC[idx];

return CacheIndicator<JEMEDIANAVARAGE2005TASC>(new JEMEDIANAVARAGE2005TASC(){ Length = length, Threshold = threshold }, input, ref cacheJEMEDIANAVARAGE2005TASC);

}

}

}

namespace NinjaTrader.NinjaScript.MarketAnalyzerColumns

{

public partial class MarketAnalyzerColumn : MarketAnalyzerColumnBase

{

public Indicators.JEMEDIANAVARAGE2005TASC JEMEDIANAVARAGE2005TASC(double length, double threshold)

{

return indicator.JEMEDIANAVARAGE2005TASC(Input, length, threshold);

}

public Indicators.JEMEDIANAVARAGE2005TASC JEMEDIANAVARAGE2005TASC(ISeries<double> input , double length, double threshold)

{

return indicator.JEMEDIANAVARAGE2005TASC(input, length, threshold);

}

}

}

namespace NinjaTrader.NinjaScript.Strategies

{

public partial class Strategy : NinjaTrader.Gui.NinjaScript.StrategyRenderBase

{

public Indicators.JEMEDIANAVARAGE2005TASC JEMEDIANAVARAGE2005TASC(double length, double threshold)

{

return indicator.JEMEDIANAVARAGE2005TASC(Input, length, threshold);

}

public Indicators.JEMEDIANAVARAGE2005TASC JEMEDIANAVARAGE2005TASC(ISeries<double> input , double length, double threshold)

{

return indicator.JEMEDIANAVARAGE2005TASC(input, length, threshold);

}

}

}

#endregion

please revert us for the same so that i can calculate this median as ninja based median is calculated on price rather than that on "Smooth"

thanks for understanding me ....

thanks in advance

Comment