Coverage for the week of May 1st - May 5th: In this week’s coverage, we examine the consolidating trends exhibited by the June E-Mini S&P 500 future and Crude Oil (CL) futures, weakness shown by the July Wheat future and an update on the June Gold future. Finally, we will provide an update on companies reporting earnings for the week, as well as economic report releases around the FOMC decision next week.

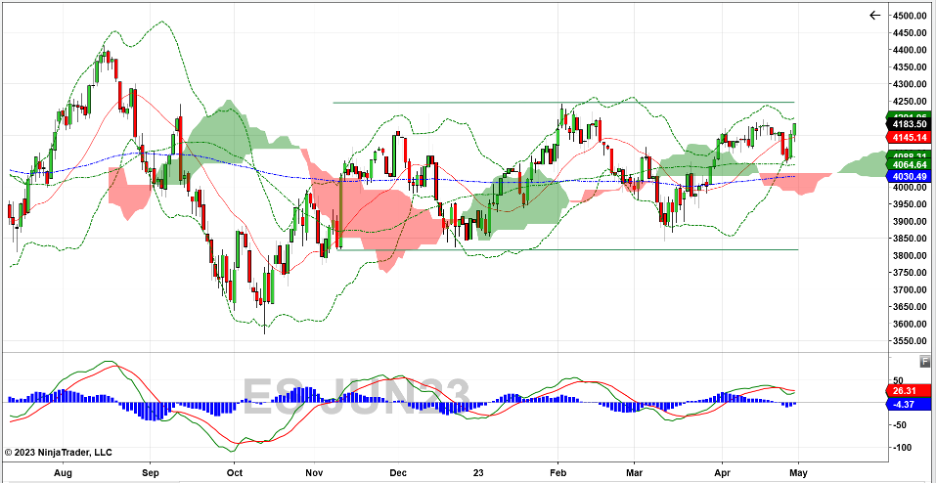

June E-Mini S&P 500 Future Daily Chart

The June E-Mini S&P 500 future rallied into the end of the week, with two consecutive bullish candles closing near their highs. Both the 50-day simple moving average and the lower Bollinger band proved to be enough to support this market, with price trading close to the upper Bollinger band. As the Bands widen, it could show a continuation of the uptrend. MACD is ready to cross its signal line to the upside, which would be another bullish indication. If the trend continues, look for resistance at 4250 (top of the current sideways range) and 4400 (previous high in August). A reversal back to a downtrend could find support at the 50-day moving average (~4065) and confluence of the 200-day moving average and the top of the Ichimoku cloud (~4035).

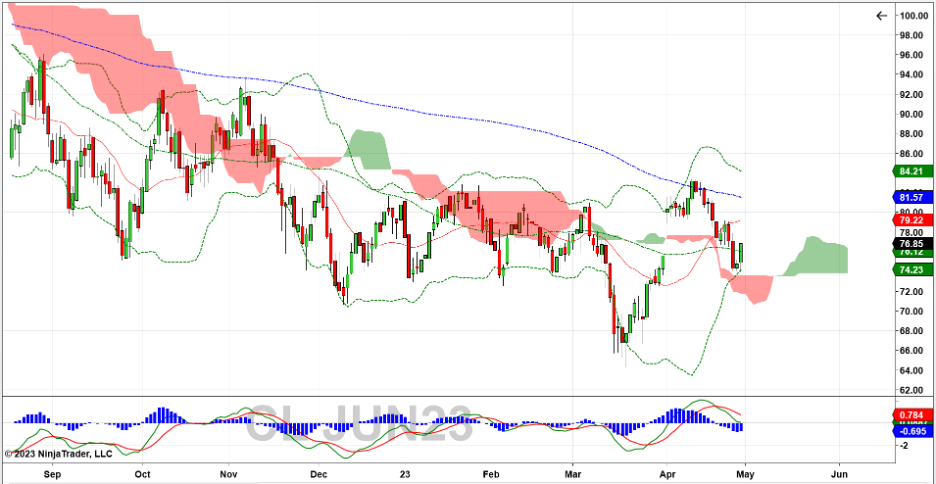

June Crude Oil Future Weekly Chart

Crude Oil (CL) futures closed down last week, closing the gap that occurred at the beginning of April. The Ichimoku cloud appears to have been supported with Friday’s reversal, also touching the lower Bollinger band before rallying to close up. MACD continues to show bearishness with the histogram continuing to trend negative. Should this reversal trend continue, look for resistance at the middle Bollinger band (~79.25) and the 200-day moving average (81.50). Should the trend revert back to the downside, look for support at the lower Bollinger band (~74.50) and the Ichimoku cloud (73.60).

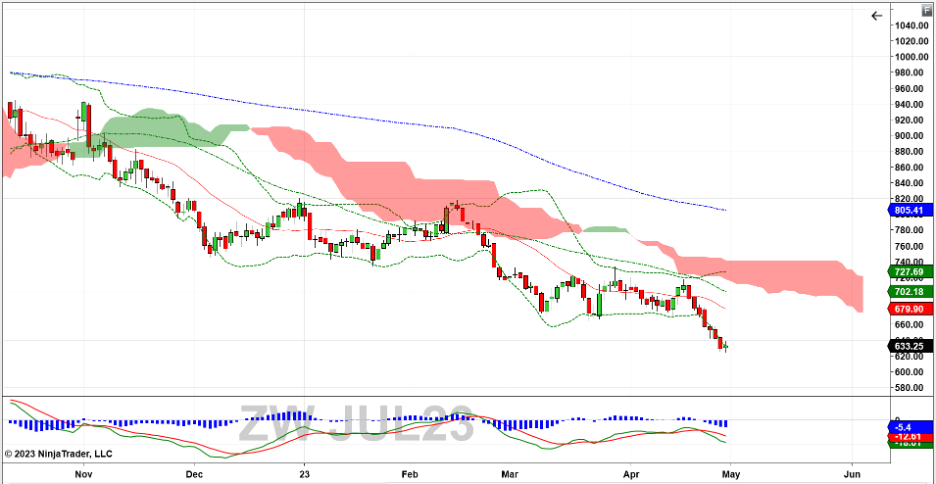

July Wheat Future Weekly Chart

The July Wheat (ZW) continued its bearish trend, making a new low on Friday. Price traded outside the lower Bollinger band last week, indicating reinforcing a bearish trend after a period of consolidation since early March. The MACD crossed below its signal line, another bearish indication. Corn trading below its 50-day moving average, 200-day moving average and the Ichimoku cloud is more evidence for a bearish case for corn. Should trends continue, support may exist at the psychological level of 600. A reverse in trend might find resistance at the 50-day moving average (~700) and the bottom of the Ichimoku cloud (~715).

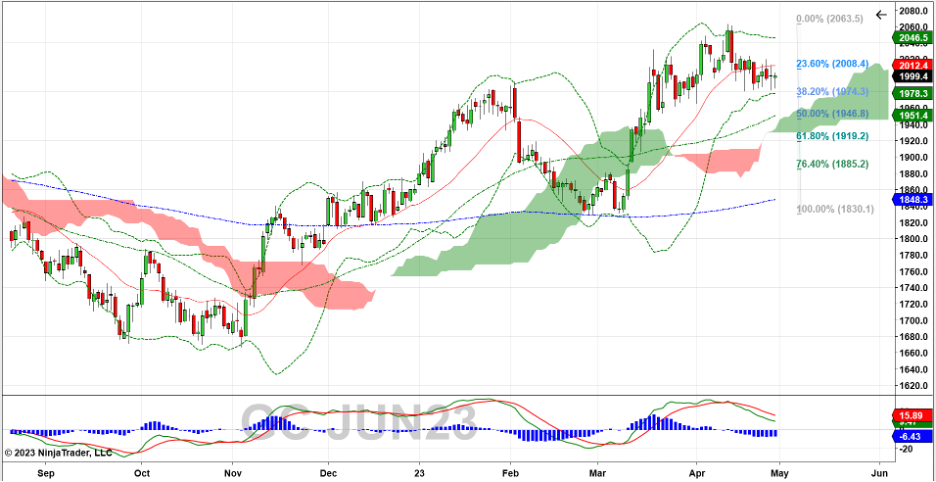

June Gold Future Weekly Chart

The June Gold (GC) future consolidated to a tight 7-point range last week after making new highs two weeks earlier. Price closed halfway between the 23.6 and 38.2 Fibonacci retracement levels of the previous bullish trend from mid-February to early April. The MACD showed a bullish cross at the highs in early April and price has been down since. Should price break down, possible support exists at the 38.2 % Fib retracement (1974) and the 50-day moving average (1950). If the price breaks out, look for resistance at the 23.6 Fib retracement level (2008) and the upper Bollinger band (~2045).

Companies Reporting Earnings May 1st – May 5th

Commentary: Over 1000 companies report earnings this week, with big names in the energy, pharmaceutical/health care and hospitality sectors. Oil companies Shell, Marathon, ConocoPhillips, Phillips66, BP, Sunoco and Sinclair report Tuesday through Thursday, and could give some guidance to the crude oil futures market.

Pfizer, Cigna Corp and CVS Health represent various aspects of the health care/pharmaceutical sector, with an estimated revenue of over $140 Billion combined for Q1 2023. The longest continuously listed company on the NYSE (Con Ed) reports Thursday afternoon.

MGM resorts and Marriott report early in the week and could be an important look into what the summer travel season has in store. Anheuser-Busch InBev reports Thursday morning, and will be interesting to see how recent marketing decisions affect current earnings and forward guidance.

| Date | Earnings Reports |

|---|---|

| Monday, May 1st | Avis Budget Group, Inc. (CAR): $3.42 EPS Estimate, $2.54B Revenue Estimate (AMC) MGM Resorts International (MGM): $0.04 EPS Estimate, $3.51B Revenue Estimate (AMC) |

| Tuesday, May 2nd | BP plc (MMM): $1.33 EPS Estimate, $58.88B Revenue Estimate (BMO) Marathon Petroleum Group (MPC): $5.75 EPS Estimate, $35.51B Revenue Estimate (BMO) Marriott International Inc. (MAR): $1.86 EPS Estimate, $5.41B Revenue Estimate (BMO) Pfizer, Inc. (PFE): $1.00 EPS Estimate, $16.67B Revenue Estimate (BMO) Sunoco, Inc. (SUN) $1.21 EPS Estimate, $4.91B Revenue Estimate (BMO) Advanced Micro Devices (AMD): $0.56 EPS Estimate, $5.30B Revenue Estimate (AMC) Ford Motor Company (F): $0.37 EPS Estimate, $36.85B Revenue Estimate (AMC) Prudential Financial, Inc. (UPS): $3.02 EPS Estimate, $13.24B Revenue Estimate (AMC) Uber Technologies, Inc. (UBER): ($0.10) EPS Estimate, $8.72B Revenue Estimate (AMC) |

| Wednesday, May 3rd | Phillips 66 (PSX): $3.59 EPS Estimate, $34.28B Revenue Estimate (BMO) CVS Health (CVS): $2.10 EPS Estimate, $80.99B Revenue Estimate (BMO) Marathon Oil Corp. (MAR): $0.57 EPS Estimate, $1.65B Revenue Estimate (AMC) Metlife Inc. (MET): $1.85 EPS Estimate, $17.07B Revenue Estimate (AMC) QUALCOMM Incorporated (QCOM): $1.83 EPS Estimate, $9.10B Revenue Estimate (AMC) |

| Thursday, May 4th | Anheuser-Busch InBev (BUD): $0.64 EPS Estimate, $14.21B Revenue Estimate (BMO) ConocoPhillips (COP): $2.02 EPS Estimate, $15.98B Revenue Estimate (BMO) HF Sinclair Corporation (DINO): $1.48 EPS Estimate, $6.97B Revenue Estimate (BMO) Hyatt Hotels Corp (H): $0.47 EPS Estimate, $1.58B Revenue Estimate (BMO) Shell plc (SHEL): $2.30 EPS Estimate, $73.74B Revenue Estimate (BMO) Consolidated Edison Inc. (ED): $1.62 EPS Estimate, $4.13B Revenue Estimate (AMC) |

| Friday, May 5th | Cigna Corp. (CI): $5.35 EPS Estimate, $45.59B Revenue Estimate (BMO) Warner Bros. Discovery (WBD): $0.21 EPS Estimate, $10.82B Revenue Estimate (BMO) |

Economic Reports for the week of May 1st – May 5th

Commentary: The big news this week is the FOMC decision at 2 p.m. ET Wednesday. While the likelihood of a 25-basis point rate hike is high, market reaction could be more volatile when Fed Chair Jerome Powell speaks at 2:30 p.m. ET. Monday reports represent the manufacturing area of the economy, shortly after market open. Insight into the labor market starts with JOLTS on Tuesday, ADP Employment on Wednesday, Challenger Job Cuts and Jobless Claims on Thursday and Employment Situation on Friday. These reports could have an impact on stock index futures when considered against FOMC policy expectations. Monday sees several agricultural reports from the USDA.

| Date | Economic Reports |

|---|---|

| Monday, May 1st | 9:45 AM ET: PMI Manufacturing Final* 10:00 AM ET: Construction Spending 10:00 AM ET: ISM Manufacturing Index* 11:00 AM ET: Export Inspections 3:00 PM ET: Grain Crushings 3:00 PM ET: Fats & Oils 4:00 PM ET: US: Crop Progress |

| Tuesday, May 2nd | 8:00 AM ET: FOMC Meeting Begins 8:00 AM ET: Motor Vehicle Sales 10:00 AM ET: Factory Orders 10:00 AM ET: JOLTS* 4:30 PM ET: API Weekly Oil Stocks |

| Wednesday, May 3rd | 7:00 AM ET: MBA Mortgage Applications 8:15 AM ET: ADP Employment Report @ADP 8:30 AM ET: Treasury Refunding Announcement 9:45 AM ET: PMI Composite Final 10:00 AM ET: ISM Services Index 10:30 AM ET: EIA Petroleum Status Report* 2:00 PM ET: FOMC Announcement*** 2:30 PM ET: Fed Chair Press Conference*** |

| Thursday, May 4th | 7:30 AM ET: Challenger Job-Cut Report 8:30 AM ET: Export Sales 8:30 AM ET: Productivity and Costs 8:30 AM ET: Jobless Claims*** 8:30 AM ET: International Trade in Goods and Services 10:30 AM ET: EIA Natural Gas Report* 4:30 PM ET: Fed Balance Sheet @federalreserve |

| Friday, May 5th | 8:30 AM ET: Employment Situation* 1:00 PM ET: Baker Hughes Rig Count 3:00 PM ET: Consumer Credit |

*** Market Moving Indicators

* Merit Extra Attention

Get Started with NinjaTrader

NinjaTrader supports more than 800,000 traders worldwide with a powerful and user-friendly trading platform, discount futures brokerage and world-class support. NinjaTrader is always free to use for advanced charting and strategy backtesting through an immersive trading simulator.

Download NinjaTrader’s award-winning trading platform and get started with a free trading demo with real-time market data today!