What is margin in futures trading?

Futures margin refers to the initial amount of money the trader is required to put up as a good faith deposit before entering a futures position.

The margin requirement for each futures contract is determined by the exchange where the contracts are traded. It represents a small percentage of the total contract value, known as the notional value. The specific margin percentage can change depending on factors such as volatility and liquidity of the underlying future.

2 Types Of Margin In Futures Trading

Initial Margin

This is the initial good-faith deposit required when opening a futures position. It acts as a safeguard against potential losses that can occur if the price moves unfavorably.

Maintenance Margin

Once a futures position is open, the maintenance margin represents the minimum account balance required to keep the position open. If a trader’s account equity falls below this minimum balance level, the trader may receive a margin call. Please be aware if you have multiple positions open, your account balance must exceed the maintenance margin required by each open position.

If you receive a margin call, you will be notified by the Trade Desk that funds must be added to your trading account to avoid liquidation of one of more positions.

Overnight margin vs. day trading margin

There are also two levels of margin requirements depending on how long a trader expects to be in an open position.

- Overnight margin is the standard margin requirement set by the exchange for traders who are holding positions overnight through the session close for one or more days.

- Day trading margin is a reduced margin for day traders to help increase leverage. To qualify for day trading margin, the trader must trade during regular market hours and must close the position before the session end time. If you forget to close a position before the end of the session, the standard overnight margin kicks back in and you could be subject to a margin call.

It's important for traders to understand the margin requirements associated with the futures contracts they trade and to monitor their account balance closely to avoid potential margin calls.

Watch Daily Live Futures Trading

Join our livestreams each weekday as we prepare, analyze and trade the futures markets in real-time using charting and analysis tools.

Intro To Technical Analysis

Learn to leverage technical analysis to target futures trading opportunities and identify trends using chart types, indicators and more.

Develop The Trader In You

Get started on your path to learn how to trade futures through our introductory video series outlining the first steps in your trading journey.

What is the relationship between leverage and margin?

Margin and leverage work together to provide the financial framework for futures trading. Leverage is the ability to control a larger position with less capital and a key differentiator of trading futures versus other asset classes.

While margin is the required amount of money needed in your account to open and maintain a position, the associated leverage available provides much greater buying power allowing you to put on more positions and trade larger numbers of contracts than otherwise possible.

Although increased leverage allows for potentially greater profits, it also comes with increased risk and the potential for greater losses. Defining a risk management strategy is a beneficial step to help traders protect their account.

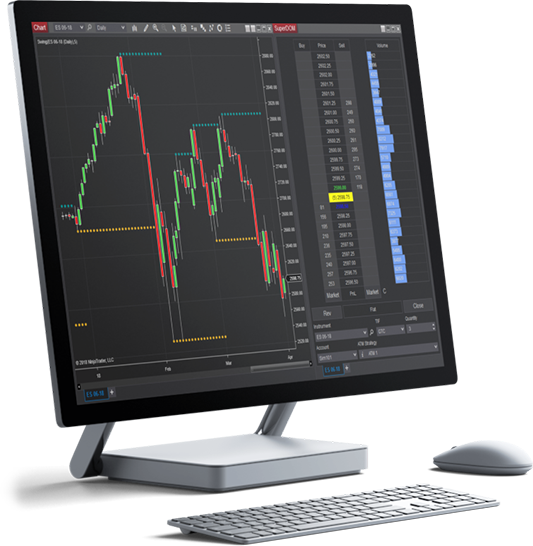

Practice with unlimited simulated trading

Every NinjaTrader account includes free unlimited simulated trading that allows you to build your experience with key concepts such as margin, contract specifications, order placement, and more.

- No minimum funding requirement to open your account

- FREE platform included - no platform fees

- Trade risk-free in our simulator until you're ready for live trading