Define Your Risk Management Strategy To Protect Your Account

Trading futures carries a significant degree of risk making a risk management plan a critical component of any trading plan and strategy. Effectively managing risk is often the difference between success and failure and can also help reduce stress when trading.

There Are Two Main Types Of Risk Management In Futures Trading

As a reminder, traders should only trade with risk capital. Risk capital is money you can afford to lose without affecting your lifestyle or changing your retirement horizon.

Account Level Risk

Many traders choose to only risk a small percentage of their total account equity on any one trade. This risk management concept is called ‘fixed fractional’. For new futures traders, starting with a smaller trade size can help reduce the overall financial risk until you consistently manage trades and are comfortable trading in a live market environment.

Trade Level Risk

At the trade level, stop loss orders play a key role in many traders’ risk management strategies to help prevent an unfavorable trade from becoming an unmanageable loss. A stop loss order refers to any order that closes out a position when the price moves against you. A safety stop should provide a reasonable risk reward profile that limits losses but also provides some room for price movement against the position without consistently being stopped out.

Customize Risk Settings For Your Brokerage Account

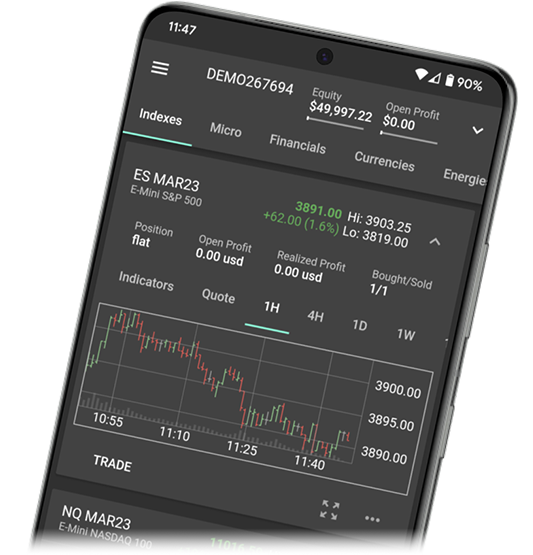

NinjaTrader brokerage clients can take advantage of customizable risk settings to help manage their account level risk.

Trailing Max Drawdown

Both end-of-day and real-time trailing max drawdown calculations can be enabled to help you track account activity versus your risk preferences.

Key Considerations To Include In Your Risk Management Strategy

Trade Sizing

Determining the appropriate trade size for your account can help you avoid significant losses allowing your to build your trading experience. Micro futures contracts are sized at 1/10 the size of traditional E-mini contracts which allows new traders to start small and then scale up as you increase your live trading experience. Traders who are struggling to reach consistency should look to limit the number of contracts and markets they are actively trading to allow for focus and attempt to reduce their overall account level risk.

Diversification

Futures products span the globe across index futures, currency futures and leading commodities. By diversifying your trading across different types of uncorrelated futures contracts and markets, traders can help reduce their overall risk exposure to highly correlated markets all moving generally in the same direction, like major market indexes, bonds, currencies, and other markets.

Know The Market Environment

Traders need to pay close attention to news stories, government reports being released or other events that may move the market significantly. There are a number of online resources available for traders to monitor noteworthy news stories including NinjaTrader’s daily livestreams at the market open and close that views upcoming news events and the potential impact on key markets.

Automate Stops And Targets With Advanced Trade Management

Advanced Trade Management (ATM) is a key element of NinjaTrader Desktop’s powerful order entry features, providing semi-automated trade functionality to help keep traders focused on their trading goals.

ATM strategies manage positions automatically to reduce the impact of emotions on trading decisions. Within milliseconds of entering a position either long or short, stop-loss and take-profit orders are submitted based on predefined settings. Capabilities available through ATMs include:

- Predefine stops and targets to bracket positions

- Use of multiple targets and stops to scale out of a position

- Create custom stop strategies for stop-loss orders

- Personalize strategy templates for easy access and repeat use

Develop The Trader In You

Get started on your futures trading journey with our exclusive video series. Watch an introduction to the basics along with actionable take aways to help you learn how to trade futures.

Simulated trading is integral for both new traders just getting started and experienced traders testing new concepts.

Opportunities to access NinjaTrader's simulated trading environment include:

- Unlimited simulation included with all funded trading accounts

- A two-week free trial with live-streaming market data

- The ability to test new trading ideas before putting money at risk