Margin is a critical concept for new futures traders to understand. When you trade futures, margin is essentially a good-faith deposit required to control a futures contract.

Futures margin is the amount of money you must have in your brokerage account to protect both the trader and broker against possible losses on an open trade. It generally represents a much smaller percentage of the contract, typically 3-12% of the notional futures contract value.

With this deposit, futures traders are able to trade instruments with a much greater value than the margin price. This is known as leverage.

Watch A Quick-Start Guide To Managing Futures Margin:

Types Of Margin

Futures trading margins fall into 2 main categories:

- Intraday Margin is the minimum account balance required by your broker to hold a position of one contract (long or short) during trading hours. This is also sometimes referred to as day trading margin.

- Initial Margin is the per-contract minimum amount required by the exchange that must be maintained in your account to hold a position overnight. This is sometimes referred to as overnight margin.*

*Please note: It is important to remember that stated margin rates are the MINIMUM needed to hold a position and not seen as the minimum to open a position. While position management is up to the individual trader, it is recommended to leave ample room for a trade to breathe and avoid margin violations. Financial leverage can result in losses greater than the initial margin and traders should be aware of the risks involved in trading futures.

Carrying A Position Overnight

An overnight position is a position, long or short, that is not closed prior to the end of the trading day. It is important to understand the risk associated with holding a position overnight, such as exposure to potential adverse price movement occurring outside of normal trading hours.

Maintaining Appropriate Excess Margin

Excess margin can be defined as the amount of equity in a brokerage account above the minimum margin requirements. Managing excess margin is an important concept in futures trading as failure to maintain sufficient levels of margin can result in possible liquidation and/or fines from the broker.

- Liquidation simply means closing out of a long or short futures position and may also be referred to as an offset. Liquidation results from having insufficient intraday margin.

- A Margin Call is a request from your broker to bring margin deposits up to their required levels to avoid full or partial liquidation. A margin call results from having insufficient initial margin.

Trading at “full leverage” means leaving no excess margin and therefore no room for error. While trading at full leverage, if a trade moves one tick against you, your position is subject to risk of forced liquidation from the trade desk. Any account in debit is considered in violation of margin requirements and subject to liquidation.

By and large, the simplest way to manage excess margin is to trade contract sizes that are appropriate for your predetermined risk levels and account size.

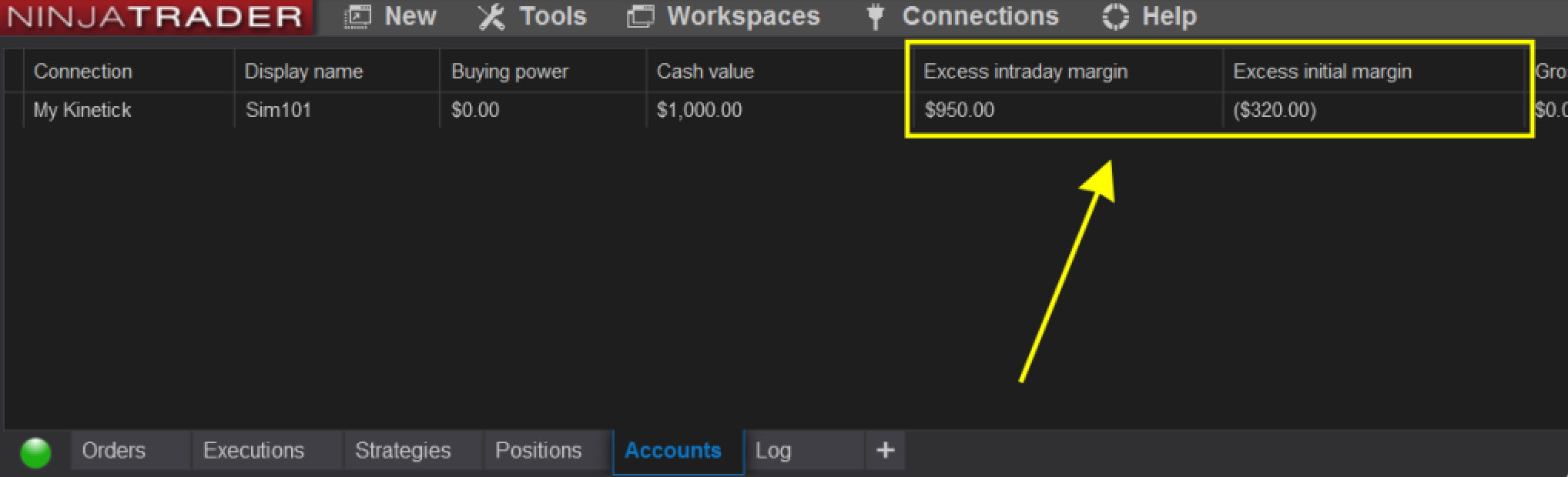

- Tip: Use NinjaTrader’s Excess Margin account display to monitor available margin directly through the platform!

Position Limits

A position limit is a preset number of contracts a trader may hold, long or short, at any one time. These limits are in place to control the total market exposure of a trader and determined by the typical liquidity and volatility of each market.

Margins Are Subject To Market Conditions

Margins can be changed by both the exchange and broker especially in times of high market volatility, with limited or no prior notice to traders. To accommodate increased risk, higher margin may be required. When heightened volatility subsides, margin requirements are often reduced back to previous levels.

Practice Margin Maintenance With NinjaTrader

Before trading live, we encourage traders to download NinjaTrader for FREE & practice position management based on your personal risk tolerance in real market conditions via NinjaTrader’s free unlimited simulated trading environment!