In the world of futures trading, where every tick represents money made or lost, understanding the richness and nuances of certain key market indicators is vital. Among these, Bollinger Bands stand out as a lighthouse for traders navigating the turbulent financial markets.

In this blog post, you’ll learn the value of the Bollinger Band indicator, its calculation, and its critical role in helping traders identify market sentiment, overbought and oversold conditions, and subtle and not so subtle changes in volatility.

What are Bollinger Bands and How Do I Read Them?

The Bollinger Band is simple in its construction but firmly based on statistical mathematics. Created by John Bollinger in the 1980s, the indicator consists of three lines:

The middle average band: a simple moving average (SMA) of the closing prices (usually over 20 periods)

One outer band that is plotted two standard deviations above the middle SMA

One outer band that is plotted two standard deviations below the middle SMA

These standard deviations adjust dynamically with the market's volatility, expanding during volatile periods and contracting during less volatile times, thus encapsulating price movements in an envelope.

Using Bollinger Bands to Unlock Market Sentiment: Overbought and Oversold Conditions

One of the most common and compelling uses of Bollinger Bands is the ability to indicate overbought or oversold market conditions. When the price touches or breaches the upper band, the market is considered overbought, suggesting a potential pullback as traders take profits. Conversely, when prices touch or fall below the lower band, the market is deemed oversold, potentially heralding a bounce back as traders perceive value and begin buying. This dual functionality can provide traders with long and short entry and exit signals. (Figure 1)

Figure 1: Bollinger Bands overbought and oversold indications

Figure 1: Bollinger Bands overbought and oversold indications

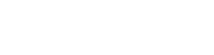

Volatility's Telltale Signs: Understanding Expansion and Contraction

Bollinger Bands are based on the concept of standard deviation and offer keen insights into market volatility. The distance between the upper and lower bands visually represents volatility:

Wider expanding bands suggest increased volatility

Narrow contracting bands indicate decreased volatility

The dynamic nature of the bands allows traders to better judge the market's variability and adjust your strategies accordingly. (Figure 2)

Figure 2: Bollinger Bands indicating volatility contracting and expanding

Figure 2: Bollinger Bands indicating volatility contracting and expanding

The Volatility Squeeze: Anticipating a Breakout

A particularly consistent phenomenon associated with Bollinger Bands is the “volatility squeeze”. This occurs when the bands tighten noticeably, signaling a significant decrease in volatility. Consider this as the calm before the storm. As the squeeze plays out, there are often substantial price breakouts above or below the recent prices, as low volatility periods are usually followed by increased market activity. (Figure 3)

Figure 3: Bollinger Bands indicating volatility squeeze and the breakout

Figure 3: Bollinger Bands indicating volatility squeeze and the breakout

Trading Beyond the Bands: The Persistence of a Trend

While Bollinger Bands serve as a guide to price behavior, markets can, and do, trend outside the bands for extended periods of time. A market trending persistently above the upper band signifies strong bullish momentum, suggesting that the trend may continue despite being in the overbought territory. Similarly, a market that remains below the lower band indicates strong bearish momentum. (Figure 4)

Figure 4: Bollinger Bands indicating the market can trend along the upper and lower bands

Figure 4: Bollinger Bands indicating the market can trend along the upper and lower bands

Add Bollinger Bands Strategies to Your Trader’s Toolkit

Bollinger Bands can provide key insights into market volatility, sentiment, and potential price reversals and are an invaluable resource in a trader's toolkit. However, as with all indicators, it is also beneficial to use Bollinger Bands in conjunction with other analysis tools to formulate a more multi-faceted trading strategy that is right for you.

Live Daily Market Analysis at Your Fingertips

Get ready for the trading day ahead as our experts prep, analyze, and trade the futures markets in real time during our daily livestream. Watch live here or catch what you missed on our YouTube channel.

Start Trading With NinjaTrader

Sign up for your free NinjaTrader account today to kick off your 14-day trial of live simulated futures trading.