Coverage for the week of July 31st – August 4th: In this week’s coverage, we analyze the rally in the Micro NASDAQ 100 futures, downtrends in Micro Bitcoin and U.S. Treasury Bond futures and the bullish trend in Crude Oil futures. We also examine the economic reports and earnings releases expected next week.

September Micro NASDAQ 100 Future Daily Chart

The September Micro NASDAQ 100 future finished last week in positive territory, though it failed to eclipse the previous week’s high of 16062.50. MNQ is well above the 50-day moving average, the 200-day moving averages and the Ichimoku cloud, which would be considered bullish. However, RSI is showing a bit of bearish divergence as recent peak highs in the RSI are consecutively lower, while the price peaks in MNQ are higher. This could indicate weakening bullish momentum and may be followed by consolidation or even a reverse to the downside. MACD gives mixed signals as the MACD is positive (bullish) but below its signal line (bearish). Should Friday’s uptrend continue, resistance might be found at 16000 (a psychological level) and after that, December 2021’s high of 17183.75. Support might be found at the 50-day moving average (~15100).

September Crude Oil Future Daily Chart

September crude oil futures continued the rally that started a month ago, as it extended past the 76.4% retracement level as defined by the downtrend from the high, and April to the low in June. Last week saw follow through on the break above the 200-day moving average and also remained above the 50-day moving average and the Ichimoku cloud. Bullish momentum seems strong as RSI is at 67 (nearing an overbought level of 70) and the MACD is positive and above its signal line. A continuation of the bullish trend might see some resistance at ~83.50 (peak high in April), whereas a reversal down could experience support at the 61.8% Fibonacci level (~77.25).

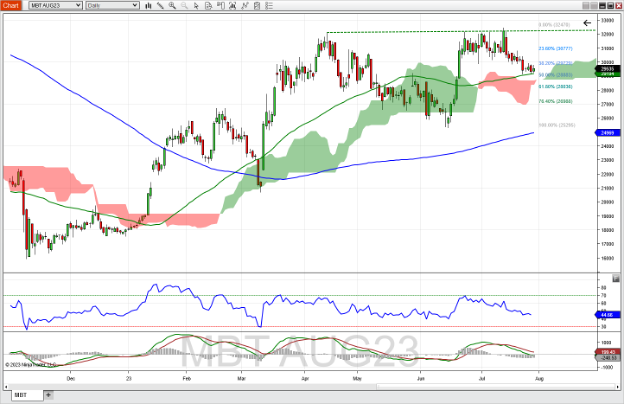

August Micro Bitcoin Future Daily Chart

The August Micro Bitcoin future found support at the 50-day moving average last week with a bullish harami pattern forming on Friday. The harami pattern consists of a small bullish bodied candle, which is encapsulated by the previous bearish candle. Bitcoin is also above the 200-day moving average and the Ichimoku cloud, indicating a bullish state. The recent downtrend from the highs in June are paralleled in the RSI and the MACD with the MACD histogram in negative territory —all bullish indications. Should Bitcoin rally, possible resistance might be found at 29730 the 38% Fibonacci retracement level from the low in June to the high in early July. Continuation of the downtrend might find support at 28880 (the 50% fib retracement level) and further at 28665, the top of the Ichimoku cloud.

September U.S. Treasury Bond Future Daily Chart

September US treasury bond future tested recent lows forming a triple bottom that began back in March. While bonds could not retest the 50-day moving average, Friday's trading showed some positive signs. Price is well below the 50-day MA, 200-day MA and the Ichimoku cloud – indicating a bearish state for bonds. The RSI is in line with price, and the MACD histogram showed a bearish bias with a cross below 0. Should Friday's rally continue, possible resistance exists at 125’20, the 23% resistance level of the downtrend formed from April to July. Further bearish activity could expect support at 122’30, a level previously tested in March and July.

Companies Reporting Earnings July 31st – August 4th

| Date | Companies Earnings |

|---|---|

| Monday, July 31st | CNA Financial Corp. (CNA): $1.12 EPS Estimate, $3.26B Revenue Estimate (BMO) Avis Budget Group, Inc. (CAR): $9.79 EPS Estimate, $3.21B Revenue Estimate (AMC) |

| Tuesday, August 1st | Uber Technologies, Inc. (UBER): $0.01 EPS Estimate, $9.33B Revenue Estimate (BMO) Pfizer, Inc. (PFE): $0.57 EPS Estimate, $13.63B Revenue Estimate (BMO) Caterpillar, Inc. (CAT): $4.51 EPS Estimate, $16.49B Revenue Estimate (BMO) * Merck & Co., Inc. (MRK): ($2.17) EPS Estimate, $14.43B Revenue Estimate (BMO) * JetBlue Airways Corporation (JBLU): $0.40 EPS Estimate, $2.61B Revenue Estimate (BMO) BP plc (BP): $1.17 EPS Estimate, $54.48B Revenue Estimate (BMO) Marriott International Inc. (MAR): $2.19 EPS Estimate, $5.97B Revenue Estimate (BMO) Toyota Motor Corp. (TM): $3.91 EPS Estimate, $69.98B Revenue Estimate (BMO) Marathon Petroleum Corp. (MPC): $4.55 EPS Estimate, $31.02B Revenue Estimate (BMO) Advanced Micro Devices, Inc. (AMD): $0.57 EPS Estimate, $4.74B Revenue Estimate (AMC) Prudential Financial, Inc. (PRU): $3.04 EPS Estimate, $12.66B Revenue Estimate (AMC) AFLAC, Inc. (AFL): $1.42 EPS Estimate, $4.46B Revenue Estimate (AMC) |

| Wednesday, August 2nd | CVS Health (CVS): $2.12 EPS Estimate, $86.44B Revenue Estimate (BMO) Humana, Inc. (HUM): $8.88 EPS Estimate, $26.19B Revenue Estimate (BMO) Phillips 66 (MA): $3.54 EPS Estimate, $34.55B Revenue Estimate (BMO) Sunoco, Inc. (SUN): $1.02 EPS Estimate, $5.71B Revenue Estimate (BMO) PayPal (PYPL): $1.16 EPS Estimate, $7.27B Revenue Estimate (AMC) Occidental Petroleum Corp. (OXY): $0.70 EPS Estimate, $6.82B Revenue Estimate (AMC) |

| Thursday, August 3rd | Anheuser-Busch InBev (BUD): $0.68 EPS Estimate, $15.54B Revenue Estimate (BMO) ConocoPhillips (COP): $1.94 EPS Estimate, $13.93B Revenue Estimate (BMO) HF Sinclair Corporation (DINO): $2.27 EPS Estimate, $7.28B Revenue Estimate (BMO) Kellogg Company (K): $1.11 EPS Estimate, $4.07B Revenue Estimate (BMO) Amazon.com Inc. (AMZN): $0.34 EPS Estimate, $131.42B Revenue Estimate (AMC) Apple, Inc. (INTC): $1.19 EPS Estimate, $72.81B Revenue Estimate (AMC) * Amgen, Inc. (AMGN): $4.44 EPS Estimate, $6.68B Revenue Estimate (AMC) * |

| Friday, August 4th | Dominion Energy, Inc. (D): $0.48 EPS Estimate, $3.72B Revenue Estimate (BMO) |

Commentary: Earnings season remains in full gear as over 1100 companies report next week. Insurance companies abound as CNA Financial, Prudential and AFLAC report their earnings on Monday and Tuesday.

Oil companies also are represented with marathon on Tuesday; Phillips 66, Occidental Petroleum and Sunoco on Wednesday; ConocoPhillips on Thursday and Dominion Energy on Friday. Earnings for these companies may be affected by the downturn in crude oil price in Q2.

Forward guidance from these companies may give insight into crude oil markets for the rest of the year. Healthcare and pharmaceutical companies are represented by Pfizer on Tuesday, and CVS Health and Humana on Wednesday.

Be especially aware of Amazon and Apple reporting after markets on Thursday as their reports could inject some volatility into the E-mini S&P, NASDAQ and Dow Jones futures. Other Dow Jones companies reporting are Caterpillar and Merck before markets open on Tuesday, and Amgen after markets close on Thursday.

Economic Reports for the week of July 31th – August 4th

| Date | Economic Reports |

|---|---|

| Monday, July 31st | 9:45 AM ET: Chicago PMI @ism 10:30 AM ET: Dallas Fed Manufacturing Survey @DallasFed 11:00 AM ET: Export Inspections 4:00 PM ET: Crop Progress |

| Tuesday, August 1st | 9:45 AM ET: PMI Manufacturing Final * 10:00 AM ET: JOLTS * 10:00 AM ET: Construction Spending 10:00 AM ET: ISM Manufacturing Index 3:00 PM ET: Grain Crushings 3:00 PM ET: Fats & Oils 4:30 PM ET: API Weekly Oil Stocks |

| Wednesday, August 2nd | 7:00 AM ET: MBA Mortgage Applications 8:00 AM ET: Bank Reserve Settlement 8:00 AM ET: Motor Vehicle Sales 8:15 AM ET: ADP Employment Report * 10:30 AM ET: EIA Petroleum Status Report |

| Thursday, August 3rd | 7:30 AM ET: Challenger Job-Cut Report 8:30 AM ET: Jobless Claims *** 8:30 AM ET: Productivity and Costs 8:30 AM ET: Export Sales 9:45 AM ET: PMI Composite Final *** 10:00 AM ET: Factory Orders 10:00 AM ET: ISM Services Index 10:30 AM ET: EIA Natural Gas Report * 11:00 AM ET: Kansas City Fed Manufacturing Index 4:30 PM ET: Fed Balance Sheet * |

| Friday, August 4th | 8:30 AM ET: Employment Situation *** 1:00 PM ET: Baker Hughes Rig Count |

*** Market Moving Indicators

* Merit Extra Attention

Commentary: The economic focus this week will be the labor market and manufacturing sector. Monday morning gives us the Chicago PMI and the Dallas Fed manufacturing survey; Tuesday sees the release of PMI manufacturing, construction spending and the ISM manufacturing index; and Thursday busy with the release of PMI composite final, factory orders, ISM services index, and the Kansas City fed manufacturing index.

Labor market reports include JOLTS on Tuesday, ADP Employment Report on Wednesday, the Challenger Job Cut report and jobless claims on Thursday and the employment situation on Friday. Be aware that Fed speakers are no longer being held to the blackout restrictions that come before an FOMC decision announcement, and therefore could give their opinions on further fed guidance at any time of the day.

Ready For More?

Learn the basics of technical analysis with our free multi-video trading course, “Technical Analysis Made Easy.”

Join our daily livestream events as we prepare, analyze and trade the futures markets in real time.

Start Trading Futures With NinjaTrader

NinjaTrader supports more than 800,000 futures traders worldwide with our award-winning trading platforms, world-class support and futures brokerage services with $50 day trading margins. The NinjaTrader desktop platform is always free to use for advanced charting, strategy backtesting, technical analysis and trade simulation.

Get to know our:

- Futures brokerage: Open an account size of your choice—no deposit minimum required—and get free access to our desktop, web and mobile trading platforms.

- Free trading simulator: Sharpen your futures trading skills and test your ideas risk-free in our simulated trading environment with 14 days of livestreaming futures market data.

Better futures start now. Open your free account to access NinjaTrader’s award-winning trading platforms, plus premium training and exclusive daily market commentary.