The NinjaTrader Desktop platform comes equipped with powerful automated trade management (ATM) capabilities that empower futures traders with semi-automated trade functionality. By using these strategies, traders can stay more focused on their trading goals.

ATM strategies manage positions automatically to reduce the impact of emotions on trading decisions. Within milliseconds of entering a position either long or short, stop-loss and take-profit orders are submitted based on predefined settings. Features available through ATMs include the ability to:

- Attach advanced orders to your entry orders on the fly

- Execute conditional or contingent orders, like bracket orders and trailing stops

- Access and employ ATM strategies easily through a user-friendly interface in both the NinjaTrader SuperDOM and Chart Trader

Get Started With ATM Strategies in Your NinjaTrader Platform

Watch this how-to video with tips to help you navigate ATM strategies as a part of your futures trading:

How to Use the NinjaTrader Custom ATM Strategy Builder for OCO Orders

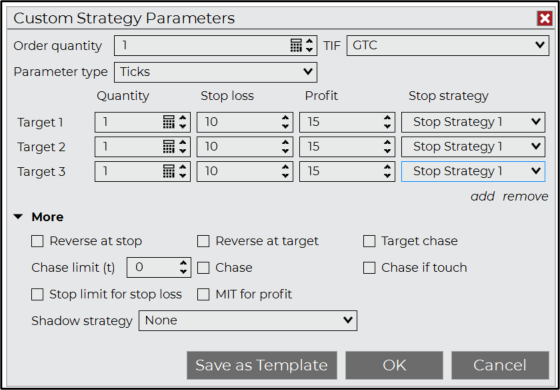

The Custom ATM Strategy Builder empowers traders to create and execute various contingent order types, including one-cancels-other (OCO) orders.

ATM Strategies: Using a Profit and Loss Exit Bracket

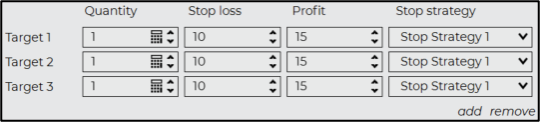

One of the most popular OCO order configurations is a simple bracket order, which can automatically place both a profit target and stop-loss order for an existing position.

When one of the orders gets triggered and filled, the other order is automatically canceled. This results in the trader being “flat,” with no active order. Additionally, multi-target OCO orders can be employed to manage multiple bracketed profit target and stoploss levels for scaling out of a multi-contract position.

ATM Strategies: Using a Trailing Stop

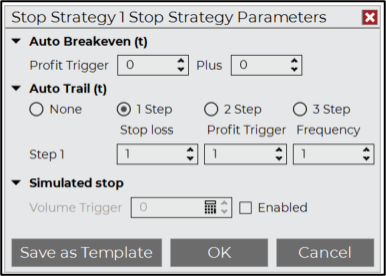

Using automated trailing stops is another common ATM strategy that allows traders the ability to move (cancel and replace) a stop order automatically based on a predetermined trailing increment. The stop order trails from the position high for a long position or trails from the position low for a short position. As the market makes new highs or lows, the trail will continue to adjust until the market retraces back to the trailing stop level and the position is exited with a profit or a loss.

ATM Strategies: Using a Breakeven Stop

Another popular ATM strategy is the auto breakeven stop, which is a risk management tool designed to prevent an already profitable trade from turning into a losing trade. The breakeven stop kicks in once a position has reached a defined minimal profit level.

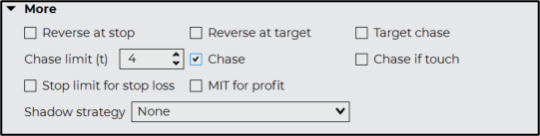

There are also other useful ATM strategies like reverse at stop, reverse at target, target chase, and limit chase, which you can employ in your trading.

Additional ATM Strategy Functions

Build and Test Your Own ATM Strategies

NinjaTrader offers ATM strategies as part of its comprehensive set of trading and analytical tools for every level of trader, which you can access by creating a free NinjaTrader account. Having the ability to place powerful conditional orders using ATM strategies like OCO brackets, trailing stops, breakeven stops, and others, helps traders limit emotional decisions and manage risk more precisely.

These ATM strategies also reinforce a disciplined approach to trading, making them valuable tools for both novice and experienced traders alike. Learn about these strategies and more platform tips with our free platform training videos.