What Are Gold Futures?

Gold futures provide traders with direct exposure to speculate on the price fluctuations of gold. As a highly liquid market, gold futures can serve as a more efficient alternative to trading gold coins, bullion, or gold mining stocks to diversify a trading portfolio.

The challenges involved with gold exploration, mining, and refining, along with its scarcity and limited supply, have helped gold to become a primary store of wealth and value for governments, corporations, and individuals all around the world, making this an exciting and dynamic futures market to trade.

Why trade gold futures?

Gold futures (contract symbol = GC) are a well-established market that provides traders with direct exposure to speculate on the price movement of gold. Gold futures trading is a much more efficient investment alternative to trading gold coins, bullion or gold mining stocks.

Around 50% of all gold produced in the world is used in the creation of jewelry and approximately another 30% of world gold production is used for investment storage by individuals and central banks. Gold is held by most central banks to help guarantee the stability of their currency, which is why it’s vitally important to the world’s financial markets. The remaining 20% of gold production is used for industrial and manufacturing purposes.

Cost effective way to participate in the gold marketplace

High liquidity compared to other asset classes

Capitalize on unique opportunities with nearly 24-hour trading with good liquidity

Diversify your trading with uncorrelated products

Trade Micro gold contracts to reduce financial commitment

At 1/10th the size of standard gold futures contracts, Micro gold futures (MGC) allow traders to access these dynamic markets with lower costs and reduced day trading margins. Other advantages of trading Micro gold contracts include:

- Increased flexibility to scale in and out of positions

- Ability to more precisely control trade size risk

- Highly leveraged investment for more buying power

Leverage also increases the risk associated with futures trading and only risk capital should be used for trading

Who trades gold futures?

Gold futures traders can be broken down into three main groups:

- Commercial traders are typically trading futures to hedge the price of gold. For example, gold mining companies that trade futures are hedging known gold reserves that are in the ground, yet to be mined. Commercial traders are typically industrial companies that use large amounts of gold to manufacture jewelry, medical devices, electronics and aerospace. They will often take delivery of gold.

- Large professional speculators are typically commodity pool operators, proprietary trading firms, institutional investors and hedge funds. These traders, along with commercial traders, make up 80% or more of the daily trading volume in gold futures. With the goal of speculating on the price movement of gold, they generally do not take delivery or hold actual gold.

- Self-directed retail traders rarely take actual delivery of gold and often avoid delivery by closing their gold futures trading contracts prior to the first notice date or expiration date of the contract.

What impacts the price of gold futures?

Geopolitical and geoeconomic factors like international conflicts, political instability, and other types of negative economic news can create uncertainty that can drive investors to purchase gold as a flight to safety. Conversely, when the international economic environment is stable and growing, the demand for gold can decrease, which can lower prices.

Watch Daily Live Futures Trading

Join our livestreams each weekday as we prepare, analyze and trade the futures markets in real-time using charting and analysis tools.

Intro To Technical Analysis

Learn to leverage technical analysis to target futures trading opportunities and identify trends using chart types, indicators and more.

Develop The Trader In You

Get started on your path to learn how to trade futures through our introductory video series outlining the first steps in your trading journey.

Risk of gold futures trading

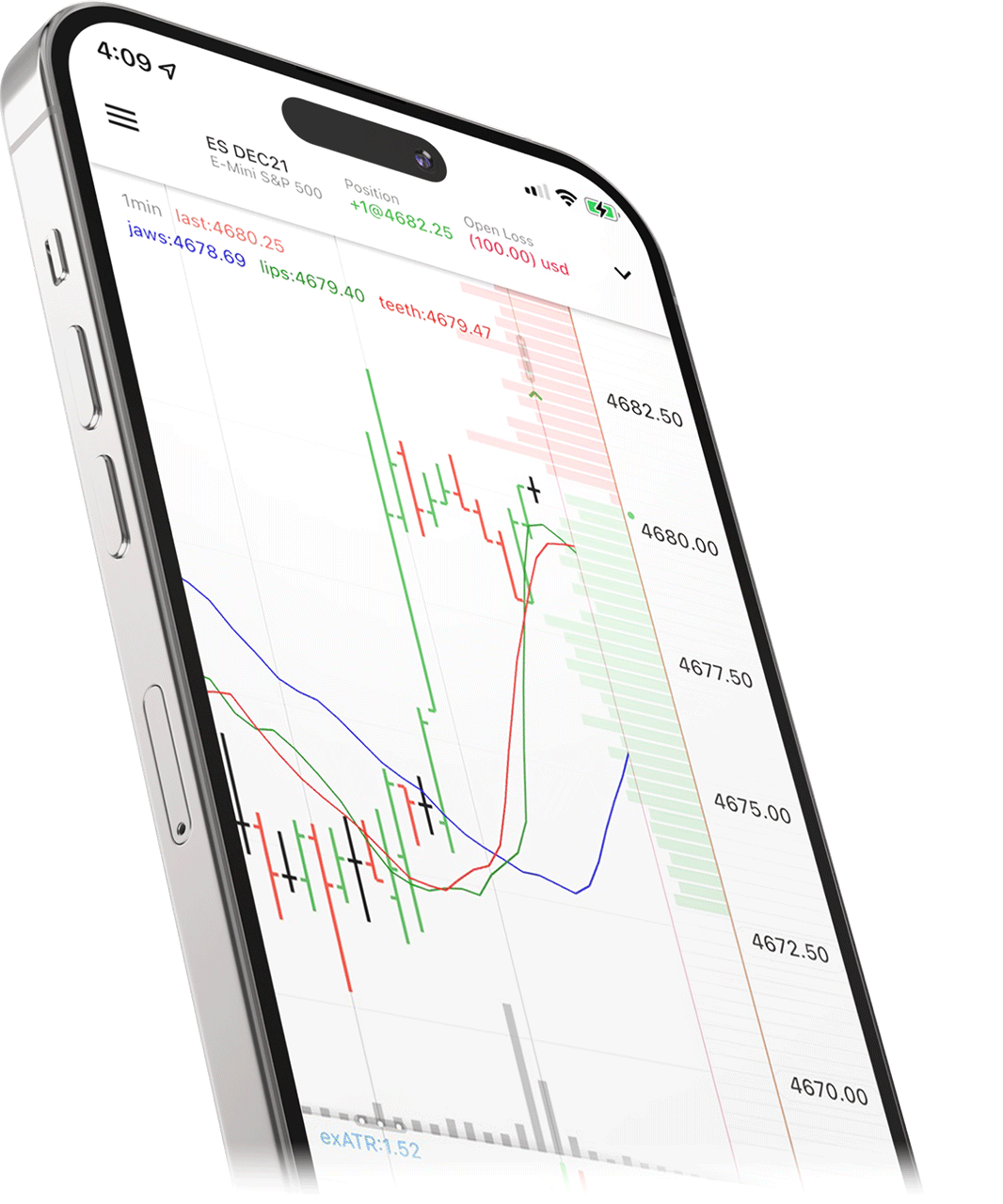

Whereas physical gold is a passive investment, trading gold futures entails a more active approach that should only be taken on by traders who have researched the market, understand contract specifications, and have a detailed, tested futures trading plan.

If you’re just getting started trading, practice in a trading simulator until you can prove to yourself that you can make simulated dollars. Then when you start to trade gold futures online with real dollars, start with small order sizes and work your way up.

With gold futures or really any futures market, it’s often easy for traders to get caught up in the excitement of the price action. Even smart experienced traders can have large losses, which is why you should define a risk management strategy and only trade with risk capital—money you can afford to lose without affecting your lifestyle or retirement horizon.

Gold Futures Contracts Specifications

Gold futures are standardized exchange-traded contracts that represent 100 ounces of gold (standard contract) or 10 ounces of gold (Micro contract). You can trade Gold futures through the Chicago Mercantile Exchange (CME) on the electronic CME Globex system.

Retail traders generally buy and sell gold futures contracts to speculate that the price will go up or down and typically do not want to take delivery of the physical gold. Traders holding long or short gold positions must close their positions prior to the first notice date to avoid the possibility of being assigned delivery or required to deliver. NinjaTrader’s policy is to auto-liquidate any open physically delivered contract position going into first notice date.

| Standard Gold Futures | Micro Gold Futures | |

|---|---|---|

| Symbol | GC | MGC |

| Exchange | CME GLOBEX | CME GLOBEX |

| Contract point value | 100 troy ounces | 10 troy ounces |

| Minimum price fluctuation | 0.10, (100 * 0.1 = $10.00 per-contract per-minimum move) | 0.10, (10 * 0.1 = $1.00 per-contract per-minimum move) |

| Trading hours | Sunday 6:00 pm ET to Friday 5:00 pm ET | Sunday 6:00 pm ET to Friday 5:00 pm ET |

| Listed contracts | Monthly contracts listed for 3 consecutive months, any Feb(G), Apr(J), Aug(Q), and Oct(V) in the nearest 23 months and any Jun and Dec in the nearest 72 months. | Monthly contracts (Feb(G), Apr(J), Jun(M), Aug(Q), Oct(V), and Dec(Z) in the nearest 24 months |

| First notice date^ | Last trading day of the month prior to the contract month | Last trading day of the month prior to the contract month |

| Expiration style | Trading ceases at 1:30 pm ET on the third last business day of the contract month | Trading ceases on the third last business day of the prior to contract month |

| Settlement | Deliverable | Deliverable |

| Additional Specifications | View all from CME Group | View all from CME Group |

Become a gold futures trader today

Ready to start trading gold futures and Micro gold futures? NinjaTrader is here to support you by providing industry-leading gold futures broker services. With an award-winning trading platform and daily premium market commentary with industry pros, NinjaTrader equips you with the tools you need to embark on your futures trading journey.