What are futures contract specifications?

Futures contract specifications are the terms and conditions that govern the way a particular futures contract is traded.

Contract specifications are set by the futures exchange where a contract is traded and include the following data points:

- The underlying asset

- The size of the contract

- The minimum traded price increment

- Expiration months and style

- The settlement method

Why are futures contract specifications important for futures traders?

Understanding contract specifications is fundamental for effective trading in the futures markets.

At some time or another, most futures traders will make an order placement error related to contract specifications. Whether it’s typing in the wrong symbol or placing a trade just before market close or contract expiration, most futures traders have been there.

Most of these potential errors can be avoided by simply double checking the contract specifications before placing a trade. As a rule of thumb, never assume that any two futures products have the same contract specifications.

Definitions Related to Contract Specifications

Underlying market

Examples: (ES) S&P 500 Stock Index, (CL) Crude Oil, or (GC) Gold

A futures price is derived from the underlying asset. The underlying asset can be commodities, bonds, or a major market stock index.

Contract size or point value

Examples: ES (50 points), CL (1000 barrels), or GC (100 ounces)

The contract size or point value determines the quantity of the underlying asset that is being traded. For every full 1-point move, the value of a futures contract goes up or down the point value. For example, if you buy 1 gold contract and gold goes up from 2000 to 2001, the contract is $100 more profitable. (1pt move x $100 per contract)

Minimum price increments

Examples: ES (.25), CL (.01), or GC (.10)

Minimum price increments refer to the smallest unit of price movement for a contract, often called a tick. If you multiply the minimum price increment by the point value, you get the dollar value for a minimum price increment move. For example, ES: (50 * .25 = $12.50 per contract per minimum move) or GC: (100 * 0.1 = $10.00 per contract per minimum move).

Trading hours

Trading hours or session hours are the market opening and closing times when orders can be placed to open or close a position. Many futures contracts trade in the 24-hour CME Globex session which starts at 6:00pm ET on Sunday and goes to Friday’s close at 5:00pm ET.

Some futures markets only trade on weekdays during regular daytime hours and can close in the early afternoon eastern time. This is a contract specification you should always double check before trading any new instrument, especially agricultural commodities.

Available contract months

All futures markets have a number of available current contracts to trade with varying expiration months dated into the future, however not all markets have contracts that expire every month. This is because the delivery for certain commodities or other considerations may vary contract by contract throughout the year. As a result, futures exchanges only offer contracts for specific delivery months that align with the seasonal or market demands for those commodities or assets.

As an example, E-mini S&P (ES) futures only have tradable contract months in a quarterly pattern: March (H), June (M), September (U), December (Z).

It is important to note that most of the trading volume occurs in the current front month contract where liquidity keeps bid/ask spreads tight and entering and exiting a position is generally easier. Traders should always be aware when trading will roll or shift to the next available contract month.

Settlement method

The settlement method refers to how an open futures position will be resolved or settled at expiration date. There are two types of settlement methods:

Cash settlement means that the parties settle the contract's value (P&L) in cash. This is the primary settlement method for major market index futures contracts.

Physical delivery means that the buyer of the futures contract receives the underlying asset at the agreed-upon price and amount from the seller.

The settlement method can vary depending on the type of underlying asset and the exchange where the contract is traded. Generally, retail traders do not need to worry about taking delivery or needing to deliver the commodity in question.

Expiration date or style

Futures contracts have a specified date on which they expire and positions are settled after the expiration date based on the exchange rules. Retail traders can hold positions in financially settled futures like the E-mini S&P 500 until the expiration date but must close positions in physically delivered futures markets like gold or crude oil futures prior to first notice date. Retail futures traders that are long rarely if ever take delivery and shorts rarely if ever make delivery of the physical asset. Learn more about futures delivery.

It's important to be aware of the exact expiration time and date so that you can effectively manage your positions. Learn more about position management.

First notice date

If you are trading a futures contract with a ‘delivery’ style settlement method, then the first notice date is an important date to know. It marks the first day on which a buyer of a futures contract can be assigned to take delivery of the physical commodity or asset. For example, if you are trading crude oil futures, the first notice date would be the first day on which a buyer of the contract could be assigned to take delivery of physical barrels of crude oil.

The first notice date varies depending on the futures contract and the exchange where it is traded. If you are holding a long or short position in a futures contract, it's important to close or roll your position prior to first notice date to avoid auto-liquidation of your position by your broker. Learn more about futures delivery.

Watch Daily Live Futures Trading

Join our livestreams each weekday as we prepare, analyze and trade the futures markets in real-time using charting and analysis tools.

Intro To Technical Analysis

Learn to leverage technical analysis to target futures trading opportunities and identify trends using chart types, indicators and more.

Develop The Trader In You

Get started on your path to learn how to trade futures through our introductory video series outlining the first steps in your trading journey.

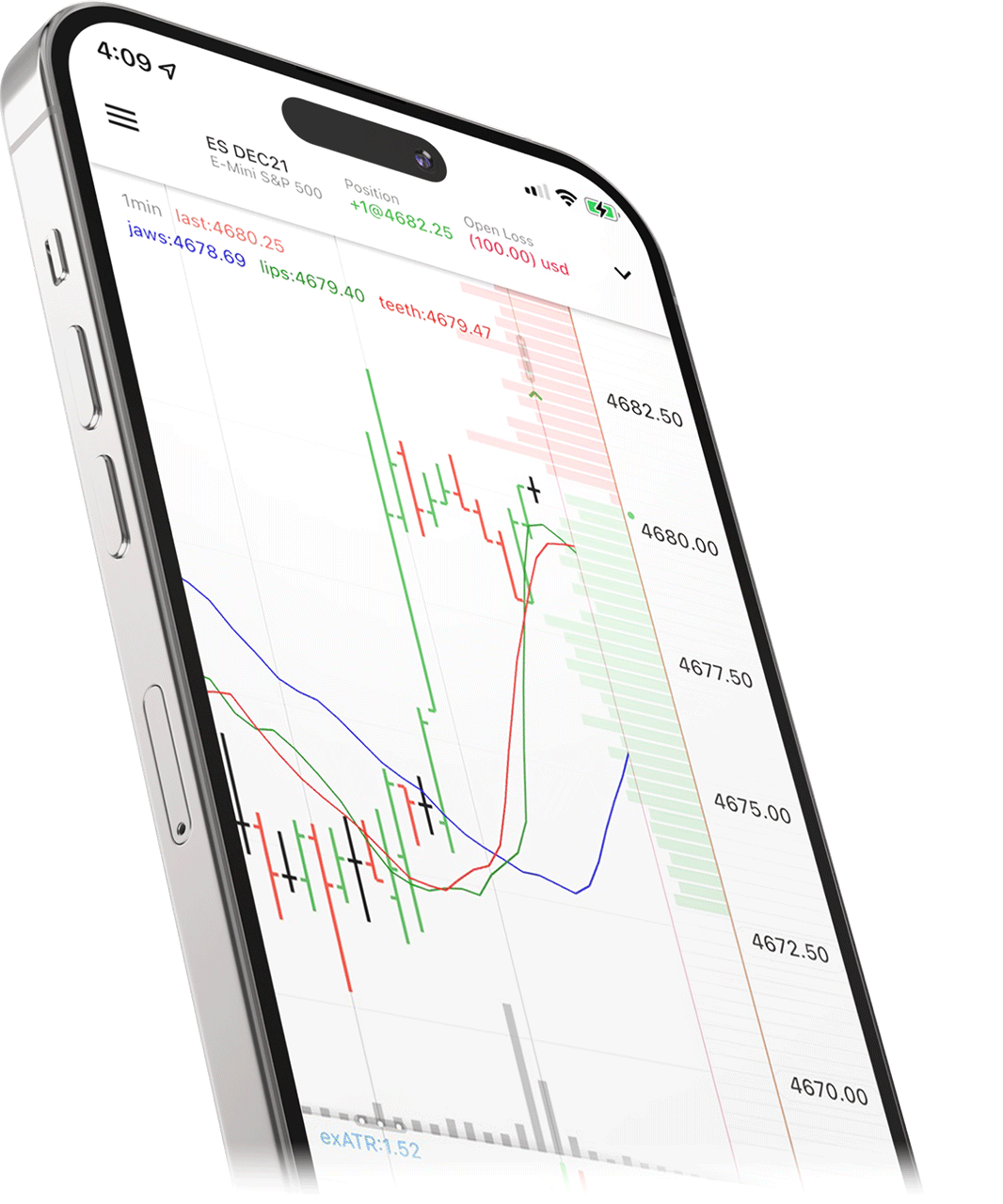

The required margin to place a futures trade

Futures margin refers to the initial amount of money the trader is required to put up as a good faith deposit before entering a new position. Margin ensures that the trader has sufficient funds to cover any potential losses. Futures margin rates are normally a small percentage of the total contract value, allowing the trader to control a larger position with fewer dollars. There are two types of margin rates traders need to understand.

- Initial Margin – Initial margin is the initial margin amount required when opening a futures position. Margin rates are set by the exchange and are subject to change based on market volatility.

- Maintenance Margin – Once a futures position is open, the maintenance margin represents the minimum account balance required to keep a position open. If the account equity falls below this level, the trader may receive a margin call requiring additional funds to be deposited into the trader’s account.

Tips for new futures traders entering the markets

Admittedly, when it comes to futures trading, there's a few things to keep track of across the many available markets to trade, particularly since each futures contract will have its own unique set of specifications and characteristics.

By focusing on just a few markets to start, new traders can build familiarity with those contracts before exploring new products and the associated specifications. Make it your routine to double check the contract specifications before trading any new symbol to help reduce the chances of making a costly trading mistake.

Getting started with NinjaTrader’s free trading simulator to practice trade risk-free is an ideal way to gain experience and familiarity with contract specifications without having real money on the line.