In this week’s coverage, we analyze the bullish trends in copper and euro FX futures, the bearish trend in WTI crude oil futures, and the pullback in the E-mini Russell 2000. We also examine the economic and earnings reports expected next week.

Commentary and charts reflect data at the time of writing. Market conditions are subject to change and may not reflect all market activity.

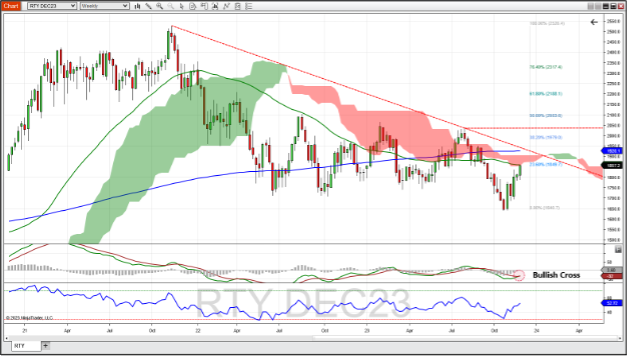

December E-Mini Russell 2000 Index Futures Weekly Chart

December E-mini Russell 2000 Index futures continued its bullish run with its third consecutive green candle closing into the Ichimoku cloud and above its 52-week moving average. This also coincides with a close above the 23.6% Fibonacci retracement level of the trend measured from the high in November 2022 to the low in October 2023. With this move up, the MACD showed a bullish cross indication by crossing its signal line. RSI is trending up along with price. A continuation of this uptrend might find resistance at the top of the Ichimoku cloud (~1,906) and at the 200-week moving average (~1,930). A reversal to the downside might find support at the recent lows at the end of October (~1,640).

January WTI Crude Oil Futures Weekly Chart

January WTI crude oil futures looked like they were ready to finish the week positive for the first time in six weeks, but a midday $2.50 decline on Friday kept crude oil down a negative path. Crude remained under the 52-week moving average, and is trending toward the bottom of the Ichimoku cloud. A close below the cloud would also be a bearish indication. The MACD study gave a bearish cross indication about four weeks ago and RSI is trending toward oversold levels but has room to get there. Should the downtrend continue, support might be found at the 76.4% Fibonacci retracement level (~71.60) and further at the peak low from early May (61.60). A reversal to the upside might find resistance at the 61.8% Fib level (75.85), and the top of the Ichimoku cloud (~84.00).

December Euro FX Futures Weekly Chart

December euro FX futures showed a little bit of weakness last week as the market showed a bearish engulfing candle pattern, wherein the body of last week’s red candle engulfs the previous green candle’s body. This occurred at the top of the Ichimoku cloud, finishing the week with a close below the 52-week moving average, which is considered a bearish indication. This shows a bit of conflicting information as a bullish cross indication occurred three weeks ago. RSI has turned down, in line with current price action. Should this trend reversal continue, look for support at the 38.2% Fibonacci retracement level (1.08147). A resumption of the bullish trend might find resistance at the 61.8% Fib retracement level (1.10203).

March Copper Futures Weekly Chart

March copper futures continued to rally off the recent low in October, gaining 2% last week. This move put copper into the Ichimoku cloud and above its 200-week moving average. It also crossed above a downward sloping resistance line that began in January this year, finding resistance at the 52-week moving average. The MACD gave a bullish indication 2 weeks ago when it crossed above the signal line, but shows even more bullish potential as it has yet to cross above the zero line. Should this trend continue, resistance might be found at the top of the Ichimoku cloud, which coincides with the 50% Fibonacci retracement of the downtrend that started in January (~4.0000). A reverse to the downside might find support at the 23.6% Fib level (3.7687).

Companies Reporting Earnings December 4 – December 8

As the latest earnings season wraps up, just a handful of companies are reporting this week. Retail is the theme as AutoZone and Smuckers report Tuesday morning, Campbell’s Soup and Chewy Inc. report on Wednesday, and Dollar General and lululemon report on Thursday.

Toll Brothers reports earnings after markets on Tuesday, and that could provide some insight into the status of the housing market. Meme stock GameStop reports after markets Wednesday. Earnings season will resume mid-January 2024 with companies reporting on Q4 performance.

| Date | Companies Earnings |

|---|---|

| Monday, December 4 | N/A |

| Tuesday, December 5 | AutoZone, Inc. (AZO): $31.04 EPS Estimate, $4.19B Revenue Estimate (BMO) J.M. Smucker, Co. (SJM): $2.47 EPS Estimate, $1.95B Revenue Estimate (BMO) Toll Brothers, Inc. (TOLL): $3.64 EPS Estimate, $2.78B Revenue Estimate (AMC) |

| Wednesday, December 6 | Campbell Soup Co. (CPB): $0.87 EPS Estimate, $2.53B Revenue Estimate (BMO) GameStop Corp. (GME): $-0.12 EPS Estimate, $1.18B Revenue Estimate (AMC) Chewy, Inc. (CHWY): $-0.06 EPS Estimate, $2.81B Revenue Estimate (AMC) |

| Thursday, December 7 | Dollar General Corporation. (DG): $1.19 EPS Estimate, $9.65B Revenue Estimate (BMO) Lululemon (LULU): $2.27 EPS Estimate, $2.19B Revenue Estimate (AMC) |

| Friday, December 8 | N/A |

* indicates that this company is in the Dow Jones Index

Economic Reports for the week of December 4 – December 8

As Fed speakers refrain from comments due to the 11-day quiet period ahead of the next FOMC meeting, market participants will rely on economic reports focusing largely on manufacturing and labor situation.

PMI Composite and Factory Orders start the week Monday right after stock market opens. ISM Services reports on Tuesday before market open, and Wholesale Inventories arrives at 10 AM Thursday.

On the labor front, the Job Openings and Labor Turnover Survey (JOLTS) could introduce some volatility on Tuesday at 10 AM. ADP Employment (8:15 AM Wednesday) and the Challenger Job-Cut report (7:30 AM Thursday) might have minor impact on the markets.

More importantly, the weekly Jobless Claims report at 8:30 AM Thursday and the monthly Employment Situation report at 8:30 AM Friday could have a major impact on the markets. Also: at noon on Friday, the monthly Supply and Demand report (WASDE) from the U.S. Department of Agriculture could impact the corn, soybean, cotton and wheat markets.

| Date | Economic Reports |

|---|---|

| Monday, December 4 | 7:00 AM ET: Motor Vehicle Sales 9:45 AM ET: PMI Composite Final 10:00 AM ET: Factory Orders 11:00 AM ET: Export Inspections |

| Tuesday, December 5 | 10:00 AM ET: ISM Services Index 10:00 AM ET: JOLTS * 4:30 PM ET: API Weekly Oil Stocks |

| Wednesday, December 6 | 7:00 AM ET: MBA Mortgage Applications 7:00 AM ET: Bank Reserve Settlement 8:15 AM ET: ADP Employment Report * 8:30 AM ET: International Trade in Goods (Advance) 8:30 AM ET: Productivity and Costs 10:30 AM ET: EIA Petroleum Status Report * |

| Thursday, December 7 | 7:30 AM ET: Challenger Job-Cut Report 8:30 AM ET: Export Sales 8:30 AM ET: Jobless Claims *** 10:00 AM ET: Wholesale Inventories (Preliminary) 10:30 AM ET: EIA Natural Gas Report * 3:00 PM ET: Consumer Credit 4:30 PM ET: Fed Balance Sheet |

| Friday, December 8 | 8:30 AM ET: Employment Situation *** 10:00 AM ET: Consumer Sentiment 12:00 PM ET: USDA Supply/Demand - Corn, Wheat, Soybean, Cotton *** 12:00 PM ET: Crop Production 1:00 PM ET: Baker Hughes Rig Count 3:00 PM ET: Fats & Oils 3:00 PM ET: Grain Crushings |

*** Market Moving Indicators

* Merit Extra Attention

Ready For More?

Learn the basics of technical analysis with our free multi-video trading course, “Technical Analysis Made Easy.”

Join our daily livestream events as we prepare, analyze and trade the futures markets in real time.

Start Trading Futures With NinjaTrader

NinjaTrader supports more than 800,000 futures traders worldwide with our award-winning trading platforms, world-class support and futures brokerage services with $50 day trading margins. The NinjaTrader desktop platform is always free to use for advanced charting, strategy backtesting, technical analysis and trade simulation.

Get to know our:

- Futures brokerage: Open an account size of your choice—no deposit minimum required—and get free access to our desktop, web and mobile trading platforms.

- Free trading simulator: Sharpen your futures trading skills and test your ideas risk-free in our simulated trading environment with 14 days of livestreaming futures market data.

Better futures start now. Open your free account to access NinjaTrader’s award-winning trading platforms, plus premium training and exclusive daily market commentary.