What Are Crude Oil Futures?

The crude oil futures market is highly liquid and allows futures traders to directly speculate on the price fluctuations of crude oil. As one of the world’s most active commodities, crude oil futures provide an opportunity to trade an uncorrelated market when compared to highly correlated investments like stocks.

Crude oil is predominantly used as a major source of energy and can also be refined into a wide variety of products including gasoline, diesel fuel, jet fuel, heating oil, and petroleum gas. As crude oil impacts daily life for individuals, corporations, and countries across the globe, challenges related to oil exploration and production along with geopolitical influences make crude oil futures a particularly dynamic and active market to trade.

Why Trade Crude Oil Futures?

Crude oil futures (contract symbol = CL) are a well-established market that provides futures traders with direct exposure to speculate on the price movement of this limited resource. Benefits of trading futures include:

Cost-effective trading on one of the world’s most active commodities

High liquidity compared to many other asset classes

Nearly 24-hour trading to capitalize on unique opportunities

Flexible contract sizes - start small with micro contracts then scale up

Trade Micro Crude Oil Futures to Reduce Costs

At 1/10th the size of the standard contract, Micro crude oil futures (MCL) allow traders like you to access the highly liquid crude oil marketplace with a reduced financial commitment. Other advantages of trading micro crude oil futures include:

- The ability to target opportunities in a popular energy market

- Highly leveraged investment for more buying power

- Reduced financial commitment vs. a larger crude oil contract

- Increased flexibility for position management

Leverage also increases the risk associated with futures trading and only risk capital should be used for trading

Who trades Crude Oil Futures?

Crude oil futures traders can be broken down into three main groups:

- Commercial traders are typically trading crude oil futures to hedge the price for their business interests. Countries with oil reserves like Saudi Arabia, Russia, and Venezuela will sell futures contracts to lock in prices when crude oil prices increase. Large oil refinery companies, like those in India, South Korea, and UAE, buy futures contracts to lock in low prices when the price of crude oil declines.

- Large professional speculators are typically commodity pool operators, proprietary trading firms, institutional investors and hedge funds. These traders are purely speculating on the price movement of crude oil and generally do not take delivery. Typically, commercial traders and large speculators make up 80% or more of the daily trading volume in crude oil futures.

- Self-directed retail traders make up the remaining daily trading volume in crude oil futures and like large speculators, rarely take actual delivery of crude oil, but instead choose to close their future positions^ to avoid the risk of delivery.

What can affect the price of crude oil futures?

There is strong correlation between the US dollar and the crude oil market. The US dollar plays a significant role in crude oil pricing as most international crude oil transactions are conducted in US dollars, with major benchmark products such as Brent (North Sea) and WTI (West Texas Intermediate) quoted in US dollars per barrel. This means that fluctuations in the value of the US dollar can often directly impact the price of crude oil.

Geopolitical and geoeconomic factors like international conflicts and political instability can lead to supply disruption, which can drive the price of crude oil higher. The energy policies of individual countries and other groups like the Organization of the Petroleum Exporting Countries (OPEC) can also have significant effects on the price of crude oil. When it comes to trading crude oil futures, it’s important to keep abreast of current economic news and events and have a good understanding of the key fundamental pricing factors in the crude oil market.

Intro To Technical Analysis

Learn to leverage technical analysis to target futures trading opportunities and identify trends using chart types, indicators and more.

Develop The Trader In You

Get started on your path to learn how to trade futures through our introductory video series outlining the first steps in your trading journey.

Risks of crude oil futures trading

The primary risk of trading crude oil futures is that the price will go against the trader’s position. When trading crude oil futures, it can be easy for traders to get caught up in the excitement of the price action.

Using appropriate trade sizing for your account size and having a robust trading risk management plan in place that includes stop losses or a trailing stop can go a long way, helping to reduce and control your risk exposure.

Tips to keep in mind especially for newer futures traders include:

- Practice in a futures trading simulator which reflects live market conditions until you prove to yourself that you are comfortable with the market swings. Then, when you do start trading with real dollars, trade small to start, and work your way up.

- Build a well-defined futures trading plan including clear entry and exit criteria, analysis of the market conditions and a schedule for when you are and are not going to trade.

- Keep abreast of economic activity that may move the crude oil market including changes in the US Dollar against other major currencies, supply and demand dynamics, and international and domestic economic news.

Crude Oil Futures Contracts Specifications

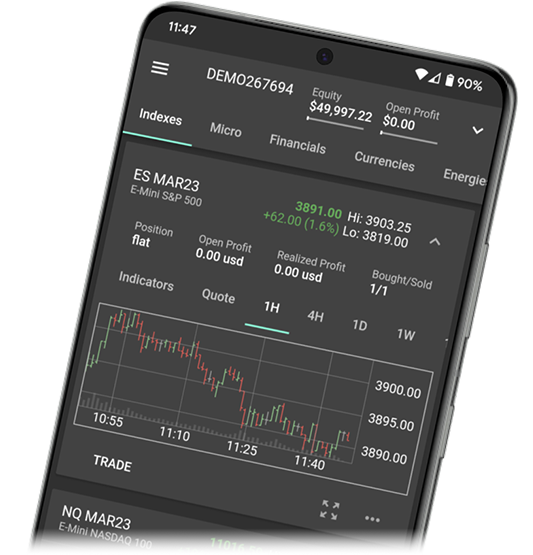

Crude oil futures are standardized exchange-traded contracts that represent 1,000 barrels of crude oil (standard contract) or 100 barrels of crude oil (Micro contract). You can trade crude oil futures through the New York Mercantile Exchange (NYMEX) on the electronic CME Globex system. Retail traders typically buy and sell crude oil futures contracts to speculate whether the price will go up or down and cannot take delivery of the physical crude oil. NinjaTrader’s policy is to auto-liquidate any open physically delivered contract position going into the first notice date.

| Standard Contract | Micro Contract | |

|---|---|---|

| Symbol | CL | MCL |

Exchange | NYMEX/CME | NYMEX / CME |

| Contract point value | 1,000 barrels | 100 barrels |

| Minimum price fluctuation | .01, (1,000 * .01 = $10.00 per-contract per-minimum move) | 01, (100 * .01 = $1.00 per-contract per-minimum move) |

| Trading hours | Sunday 6:00PM ET to Friday 5:00PM ET | Sunday 6:00pm ET to Friday 5:00pm ET |

| Listed contracts | Monthly contracts listed for the current year and the next 10 calendar years and two additional contract months. Jan.(F), Feb.(G), Mar.(H), April(J), May(K), June(M), July(N), Aug.(Q), Sept(U), Oct.(V), Nov.(X), Dec.(Z) | Monthly contracts listed for the current year and the next 12 calendar years. Jan.(F), Feb.(G), Mar.(H), April(J), May(K), June(M), July(N), Aug.(Q), Sept(U), Oct.(V), Nov.(X), Dec(Z) |

| First notice date^ | Two trading days after last trading day of the expiring contract | N/A |

| Expiration style | Trading ceases three business days before the 25th calendar day of the month prior to the contract month | Trading ceases one business day before the corresponding CL contract month or four business days before the 25th calendar of the month prior to the contract month |

| Settlement | Deliverable | Financially settled |

| Additional Specifications | View all from CME Group | View all from CME Group |

Become a Crude Oil Futures Trader Today

Ready to start trading crude oil futures and micro crude oil futures? NinjaTrader is here to support you. With award-winning features and daily premium market commentary with industry pros, NinjaTrader equips you with the tools you need to embark on your trading journey.