In this week’s coverage, we analyze the bullish trend in heating oil futures, the rallying activity in the Japanese yen and silver futures, and the sideways trend in the E-mini Dow Jones Index futures. We also examine the economic reports and earnings announcements expected next week.

Commentary and charts reflect data at the time of writing. Market conditions are subject to change and may not reflect all market activity.

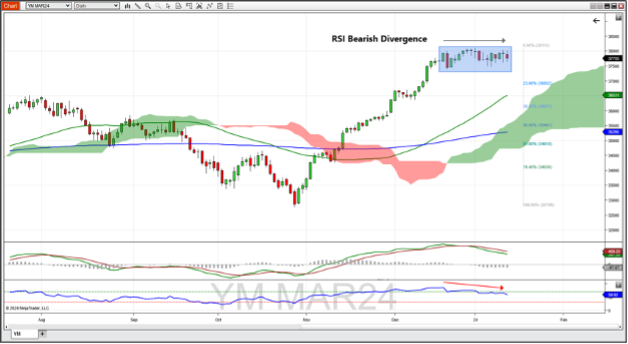

March E-Mini Dow Jones Index Futures Daily Chart

March E-mini Dow Jones Index futures remained undecided last week, as price has remained in the 37,800 – 38,110 trading range since mid-December. While Dow futures are well above the 50-day and 200-day moving averages, the momentum indicators might be warning of a weakness in the market. The RSI shows bearish divergence, which occurs when the RSI makes lower highs while the price makes equal or higher highs. The MACD crossed below its signal line to start the year, and is trending down toward the zero line. If the Dow Jones follows its momentum indicators down, support might be found at the 23.6% Fibonacci retracement level (~36,850) and the 50-day moving average (36,530). A breakout to the upside might find resistance at the recent high (38,113).

February Heating Oil Futures Daily Chart

Last week, February heating oil futures managed to remain above the 50-day moving average, though sellers pushed this market below the Ichimoku cloud, resulting in a small body bearish candle. Heating oil was also able to break above a resistant trend line found by connecting highs in September and October last year. Price is also above the 200-day moving average, which is bullish. MACD showed a bullish cross to start the week, but the MACD line itself is still below 0. RSI is still trading in line with price. A continuation of the uptrend might still see resistance at the bottom of the Ichimoku cloud (~2.75) and at the 23.6% Fibonacci retracement level (2.8653). He turned to the downside could see support at the 38.2% Fib level (2.6527) and the 200-day moving average (~2.5070).

March Japanese Yen Futures Daily Chart

March Japanese yen futures enjoyed a small rally at the end of the week, finding support at the 50-day moving average and closing right at the 50% Fibonacci retracement level of the previous uptrend, starting mid-November and finishing at the end of December. The yen started the year in a downtrend, breaking through support found by connecting lows from November of last year. This price action resulted in a bearish MACD cross wherein the MACD line crossed below its signal line. The MACD also crossed below the zero line on Friday. RSI is trending along with price. Should this rally continue, resistance might be found at the 38% Fib retracement level (0.0070983) and further up at the 200-day moving average (~0.0072110). A breakdown below the 50-day MA might find support at the 61.8% Fib level (0.0069090) and below that, the top of the Ichimoku cloud (~0.0068670).

March Silver Futures Daily Chart

March silver futures rallied Friday after seeing four consecutive down days, continuing the downtrend that started on December 22 last year. Silver tried to get back into the bottom of the Ichimoku cloud before being rejected. A head and shoulders pattern seems to have been completed, as Thursday's close was below the perceived neckline of the pattern. A measured move to the downside suggests 19.25 could be a longer-term target. This measured move is found by taking the distance between the high of the pattern in the head to the neckline and subtracting it from where the neckline was broken. MACD continues to remain negative, and the RSI rallied along with price, stopping above the oversold level of 30. Should this rally continue, resistance might be found at the 23.6% Fibonacci retracement level (23.50), the 50-day moving average (~23.95), and beyond that the 38.2% Fib level (~24.05). A resumption of the downtrend could find support at a previous low of 22.63.

Companies Reporting Earnings January 15 – January 19

Earnings season starts next week as we get reports from companies in the financial and manufacturing sectors. Companies from the financial sector hold earning calls every morning this week, with Goldman Sachs and Morgan Stanley leading the way Tuesday morning. Discover Financial Services is the rare financial institution reporting after-market this week.

In the manufacturing sector, we'll see Taiwan Semiconductor Thursday morning and Alcoa Wednesday morning. JB Hunt reports after markets on Thursday, representing the loan transportation sector company. The two Dow stocks reporting this week are Goldman on Tuesday and Travelers on Friday, which may introduce volatility to the E-mini Dow Jones Index futures should earnings or revenue disappoint or outperform. No earnings reports are dropping on Monday due to the Martin Luther King, Jr. holiday.

| Date | Companies Earnings |

|---|---|

| Monday, January 15 | Market Holiday |

| Tuesday, January 16 | Goldman Sachs Group, Inc. (GS): $3.47 EPS Estimate, $11.16B Revenue Estimate (BMO) * Morgan Stanley (MS): $1.07 EPS Estimate, $12.93B Revenue Estimate (BMO) PNC Financial Services Group, Inc. (PNC): $2.82 EPS Estimate, $5.29B Revenue Estimate (BMO) |

| Wednesday, January 17 | Charles Schwab Corp. (SCHW): $0.66 EPS Estimate, $4.55B Revenue Estimate (BMO) U.S. Bancorp (USB): $0.99 EPS Estimate, $6.83B Revenue Estimate (BMO) Alcoa, Inc. (AA): $-0.99 EPS Estimate, $2.67B Revenue Estimate (AMC) Discover Financial Services (DFS): $2.50 EPS Estimate, $4.10B Revenue Estimate (AMC) |

| Thursday, January 18 | Taiwan Semiconductor Manufacturing (TSM): $1.34 EPS Estimate, $19.08B Revenue Estimate (BMO) Truist Financial Corporation (TFC): $0.88 EPS Estimate, $5.63B Revenue Estimate (BMO) M&T Bank Corp (MTB): $3.66 EPS Estimate, $2.28B Revenue Estimate (BMO) J.B. Hunt Transport Services, Inc. (JBHT): $1.75 EPS Estimate, $3.26B Revenue Estimate (AMC) |

| Friday, January 19 | SLB (SLB): $0.84 EPS Estimate, $9.00B Revenue Estimate (BMO) Travelers Companies, Inc. (TRV): $4.97 EPS Estimate, $10.91B Revenue Estimate (BMO) * State Street Corp. (STT): $1.81 EPS Estimate, $2.95B Revenue Estimate (BMO) |

* indicates that this company is in the Dow Jones Index

Economic Reports for the week of January 15 – January 19

With a short week due to the Martin Luther King, Jr. holiday on Monday, expect some reports to be delayed or postponed one day. This includes API Weekly Stocks (moved to Wednesday afternoon) and the EIA Petroleum report (moved to Thursday at 11 AM ET).

A mix of reports cover the housing and manufacturing sectors of the economy. Housing gets its due on Wednesday morning with the MBA Mortgage Applications and Housing Market Index reports, on Thursday with Housing Starts and Permits, and on Friday with Existing Home Sales.

Tuesday morning we'll see the Empire State Manufacturing Index followed by the Philadelphia Fed Manufacturing Index on Thursday morning. Retail Sales and Business Inventories on Wednesday morning could influence markets at 8:30 AM and 10:00 AM, respectively.

The most anticipated report is the Jobless Claims report on Thursday at 8:30 AM. Fed speakers include Mary Daly (San Francisco), Raphael Bostic (Atlanta) and John Williams (New York). Note that other fed speakers may appear at any time.

| Date | Economic Reports |

|---|---|

| Monday, January 15 | Market Holiday |

| Tuesday, January 16 | 8:30 AM ET: Empire State Manufacturing Index 11:00 AM ET: Export Inspections |

| Wednesday, January 17 | 7:00 AM ET: MBA Mortgage Applications 7:00 AM ET: Bank Reserve Settlement 8:30 AM ET: Retail Sales * 8:30 AM ET: Import and Export Prices 9:15 AM ET: Industrial Production 10:00 AM ET: Housing Market Index 10:00 AM ET: Business Inventories * 10:00 AM ET: Atlanta Fed Business Inflation Expectations 2:00 PM ET: Beige Book 3:00 PM ET: New York Federal Reserve Bank President John Williams Speech 4:30 PM ET: API Weekly Oil Stocks |

| Thursday, January 18 | 7:30 AM ET: Atlanta Federal Reserve Bank President Raphael Bostic Speech 8:30 AM ET: Jobless Claims *** 8:30 AM ET: Housing Starts and Permits 8:30 AM ET: Philadelphia Fed Manufacturing Index 10:30 AM ET: EIA Natural Gas Report 11:00 AM ET: EIA Petroleum Status Report * 12:05 PM ET: Atlanta Federal Reserve Bank President Raphael Bostic Speech 4:30 PM ET: Fed Balance Sheet |

| Friday, January 19 | 8:30 AM ET: Export Sales 10:00 AM ET: Existing Home Sales * 1:00 PM ET: Baker Hughes Rig Count 3:00 PM ET: Cattle On Feed 4:00 PM ET: Treasury International Capital 4:15 PM ET: San Francisco Federal Reserve Bank President Mary Daly Speech |

*** Market Moving Indicators

* Merit Extra Attention

Ready For More?

Learn the basics of technical analysis with our free multi-video trading course, “Technical Analysis Made Easy.”

Join our daily livestream events as we prepare, analyze and trade the futures markets in real time.

Start Trading Futures With NinjaTrader

NinjaTrader supports over 1 million users worldwide with our award-winning trading platforms, world-class support and futures brokerage services with $50 day trading margins. The NinjaTrader desktop platform is always free to use for advanced charting, strategy backtesting, technical analysis and trade simulation.

Get to know our:

- Futures brokerage: Open an account size of your choice—no deposit minimum required—and get free access to our desktop, web and mobile trading platforms.

- Free trading simulator: Sharpen your futures trading skills and test your ideas risk-free in our simulated trading environment with 14 days of livestreaming futures market data.

Better futures start now. Open your free account to access NinjaTrader’s award-winning trading platforms, plus premium training and exclusive daily market commentary.