Inverted cup and handle patterns can be identified by their large crescent shape followed by a less extreme, upward retracement. The entire pattern usually takes within 3 to 6 month to develop. These patterns are meant to serve as being indicative of a bearish reversal.

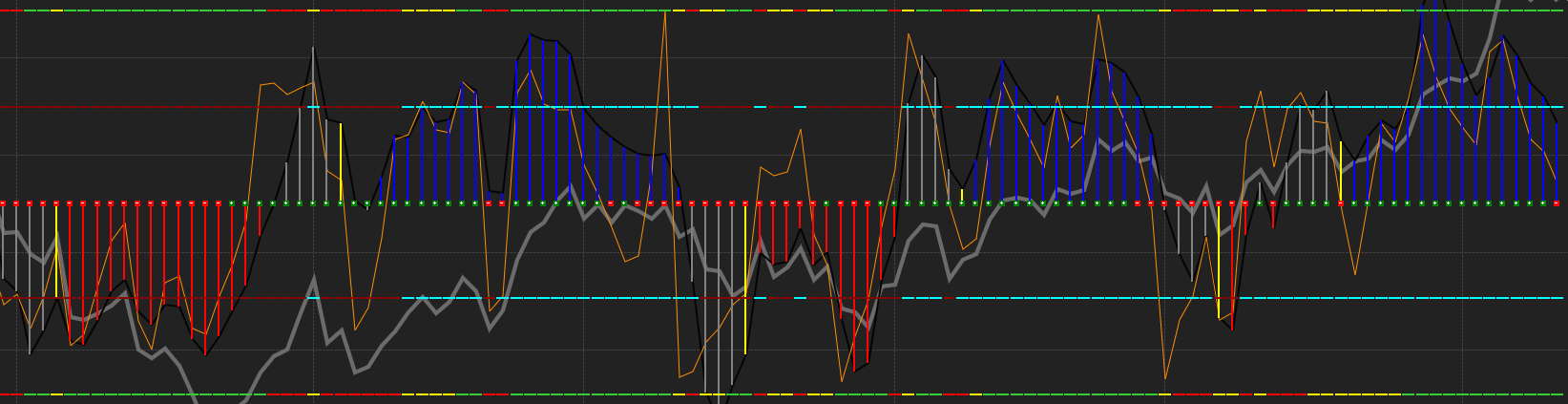

Below is a chart of the EUR|USD foreign currency pair showing an example of an inverted cup and handle pattern:

Trading the Inverted Handle

One way to think of the inverted handle is a follow-up to an inverted cup. The inverted handle retraces the initial move, but not to the level of the original trend. Once you see a retracement in the form of an inverted handle of the original inverted cup pattern, setting a stop loss while selling the trend could be a potential trade idea.

Trading the Inverted Bearish Reversal

After the cup forms and the beginning of a noticeable handle takes shape, begin to monitor trading volume closely. You might observe a steady, daily drop in volume that could potentially indicate the end of the handle’s formation is near.

Some potential trading strategy ideas are:

- Enter a short position after observing trading volume drop for a few days

- Enter a short position after a meaningful retracement of the handle

- Additionally, placing a ‘stop loss’ order at the same time as you enter your position could either limit potential losses or ‘lock in’ any potential gains

As an award-winning futures broker, NinjaTrader provides deep discount commissions and unmatched support. Download NinjaTrader free today to start analyzing inverted cup and handle patterns and building your trading strategy.