Developed in the 1960s by Gerald Appel, the MACD (Moving Average Convergence Divergence) has become one of the most popular trading indicators used in the world of technical analysis.

While a mouthful at first glance, the easily interpreted momentum indicator shows the relationship between two moving averages of prices, and plots the results in a digestible fashion.

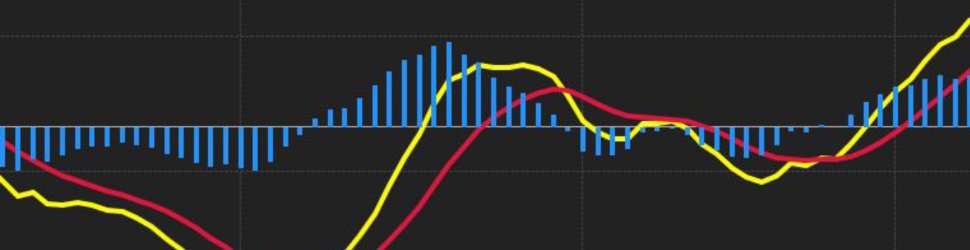

By default within NinjaTrader, the MACD line (Yellow Line) plots the difference between two exponential moving averages (EMA’s), a “Fast” 12-Day EMA and a “Slow” 26-Day EMA. Additionally, a “Smooth” or Signal Line (Red Line) is applied which is a 9-Day EMA of the MACD line.

The difference between the MACD and Signal Line are plotted as the MACD Histogram which oscillate around the Zero Line. Note when there is an MACD/Signal Line cross over, the value of the MACD Histogram is zero.

The tactics that traders often use to interpret MACD indicator to spot market trends and potential reversals can take on many forms.

Generally speaking, a positive MACD value might suggest upside momentum is increasing. A negative MACD suggests the opposite and thanks to the Zero or Center Line plotted in the histogram, traders can quickly determine positive or negative MACD values.

Crossovers are an orthodox principle to read the behavior of the MACD. Technical analysts commonly interpret a MACD crossover below the Signal Line as a bearish trigger (1). Conversely, a MACD cross above the Signal Line might be viewed as a bullish signal (2).

Another tactical use of the MACD is Divergence. As the MACD histogram bars grow in size, the difference in moving averages is increasing, and diverging away from one another, potentially indicating a continuation of trend. Converging moving averages suggest the opposite as the value of the MACD histogram bars decrease (3).

As demonstrated, the MACD can be an extremely useful tool to interpret market behavior. Because of the vast amount of information offered by the MACD it’s important for traders to study and practice trading the potential triggers. As with all lagging and non-lagging indicators, false signals can quickly lead to whipsaw’s and overtrading. NinjaTrader offers unlimited FREE simulated trading!

Download it today and start studying the MACD and your favorite market today!