What are Bitcoin Futures?

Bitcoin futures are based on the Bitcoin digital cryptocurrency. They allow you to trade your view on the price and future performance of this volatile market through a regulated exchange.

Bitcoin offers several unique benefits including a decentralized approach to finance, which means Bitcoin is not controlled by any single entity or government, allowing individuals to transfer Bitcoin without any intermediaries. Bitcoin can also offer financial stability in areas of the world where governments and banking systems are unstable.

Capped at 21 million coins, Bitcoin is similar to precious metals in that there is a limited supply. In theory, this scarcity should allow Bitcoin to hold its value and resist devaluation over time.

Why Trade Bitcoin Futures?

Bitcoin futures offer cryptocurrency enthusiasts a more direct way to participate in the price movement of Bitcoin by trading through a well-regulated broker like NinjaTrader. For those individuals holding actual Bitcoin, Bitcoin futures contracts can serve as a hedge in anticipation of lower Bitcoin prices. Read more about the advantages of trading Bitcoin futures over holding actual Bitcoin.

Additional benefits of trading Bitcoin futures include:

Ability to go long or short easily on the real-time price movement of Bitcoin

Instantaneous transactions with lower and predictable costs

No need for a digital wallet or concerns about a potential loss from hackers

Highly regulated with guaranteed transactions through CME Group

Trade Micro Bitcoin futures to reduce financial commitment

At 1/10th the size of one Bitcoin, Micro Bitcoin futures allow traders to access this highly active cryptocurrency market with reduced costs and low margins. Other advantages of trading these bite-sized contracts include:

- Highly leveraged markets for more buying power

- Start with a smaller account vs. full-size Bitcoin contract

- Increased flexibility for better position management

Micro Bitcoin futures contracts provide an ideal entry point for new futures traders to start small and scale up as you become more comfortable in the live markets.

Leverage also increases the risk associated with futures trading and only risk capital should be used for trading.

Who trades Bitcoin futures?

Bitcoin futures traders can be broken down into three main groups:

- Commercial traders in the Bitcoin futures market are typically trading to hedge their price risk on a large digital position of Bitcoin. These traders might be early Bitcoin adopters, institutional investors, or even large Bitcoin miners.

- Large professional traders in Bitcoin futures trade large position sizes, typically commodity trading advisors (CTAs), or commodity pool operators (CPOs) speculating on price direction.

- Self-directed retail traders make up the remaining daily trading volume in Bitcoin futures. Like large professional traders, they speculate only on the price movement of the futures contract.

What Can Impact the Price of Bitcoin Futures?

Even though Bitcoin futures are a uniquely digital financial instrument, prices can fluctuate significantly during the trading day. They can be sensitive to a variety of factors like economic news and reports, which also affect other financial futures markets. With Bitcoin, the basic economic principles of supply and demand are in play: Are there more buyers pushing the market up or more sellers pushing it down?

Bitcoin has the potential for highly volatile price moves. Traders need to keep abreast of new technologies, the regulatory environment, and the release and success of new cryptocurrencies to gauge the overall Bitcoin trading environment.

Intramarket Factors

Bitcoin futures volume often exceeds that of all other currencies combined. There are dozens of mainstream alternative cryptocurrencies (altcoins) to Bitcoin. When these altcoins perform well in the market with higher prices, they can increase confidence in the broader cryptocurrency market, and Bitcoin prices may trend higher.

Interest Rates and Global Economic Conditions

Changes in interest rates and monetary policy or global unrest and changing economic conditions can all impact the appeal of holding Bitcoin. News stories about new cryptocurrency regulations or Bitcoin’s adoption by large institutions or governments can also sway sentiment.

Watch Daily Live Futures Trading

Join our livestreams each weekday as we prepare, analyze and trade the futures markets in real-time using charting and analysis tools.

Intro To Technical Analysis

Learn to leverage technical analysis to target futures trading opportunities and identify trends using chart types, indicators and more.

Develop The Trader In You

Get started on your path to learn how to trade futures through our introductory video series outlining the first steps in your trading journey.

Risks of Bitcoin Futures Trading

Like every futures contract, the primary risk is that the price of Bitcoin futures will go against the trader’s position. This is especially challenging when trading Bitcoin futures as significant price moves can occur with little warning. As a result, appropriate trade sizing is paramount, as is consistently following your risk management plan, which should include a stop loss or a trailing stop.

News and events can move Bitcoin prices significantly, and traders should always keep an eye on open positions and orders with the ability to close or adjust orders quickly.

If you are a new cryptocurrency futures trader, practicing in a futures trading simulator with live market data can help you prepare for market swings and test your strategy before trading with real money.

Micro Bitcoin Futures Contract Specifications

Micro Bitcoin futures provide an efficient, cost-effective way to fine-tune your Bitcoin exposure and meet your trading objectives. At just 1/10th the size of one Bitcoin, this reduced contract size enables traders of all account sizes to speculate or hedge the price of Bitcoin.

You can trade Micro Bitcoin futures on the 24-hour electronic CME Globex system. Bitcoin futures contracts are cash settled at expiration.

| Micro Bitcoin Futures | |

|---|---|

| Symbol | MBT |

Exchange | CME Globex |

| Contract point value | 0.10 Bitcoin |

| Minimum price fluctuation | $5, (0.10 * 5 = $0.50 per-contract per-minimum move) |

| Trading hours | Sunday 6:00 pm ET to Friday 5:00 pm ET |

| Listed contracts | Monthly contracts listed for 6 consecutive months out, quarterly contracts (Mar(H), Jun(M), Sep)U), Dec(Z)) listed for 4 additional quarters, and a second Dec(Z) contract if only one is listed |

| Expiration style | Trading ceases 11:00 am ET on the last Friday of the contract month |

| Settlement | Financially settled |

| Additional Specifications | View all from CME Group |

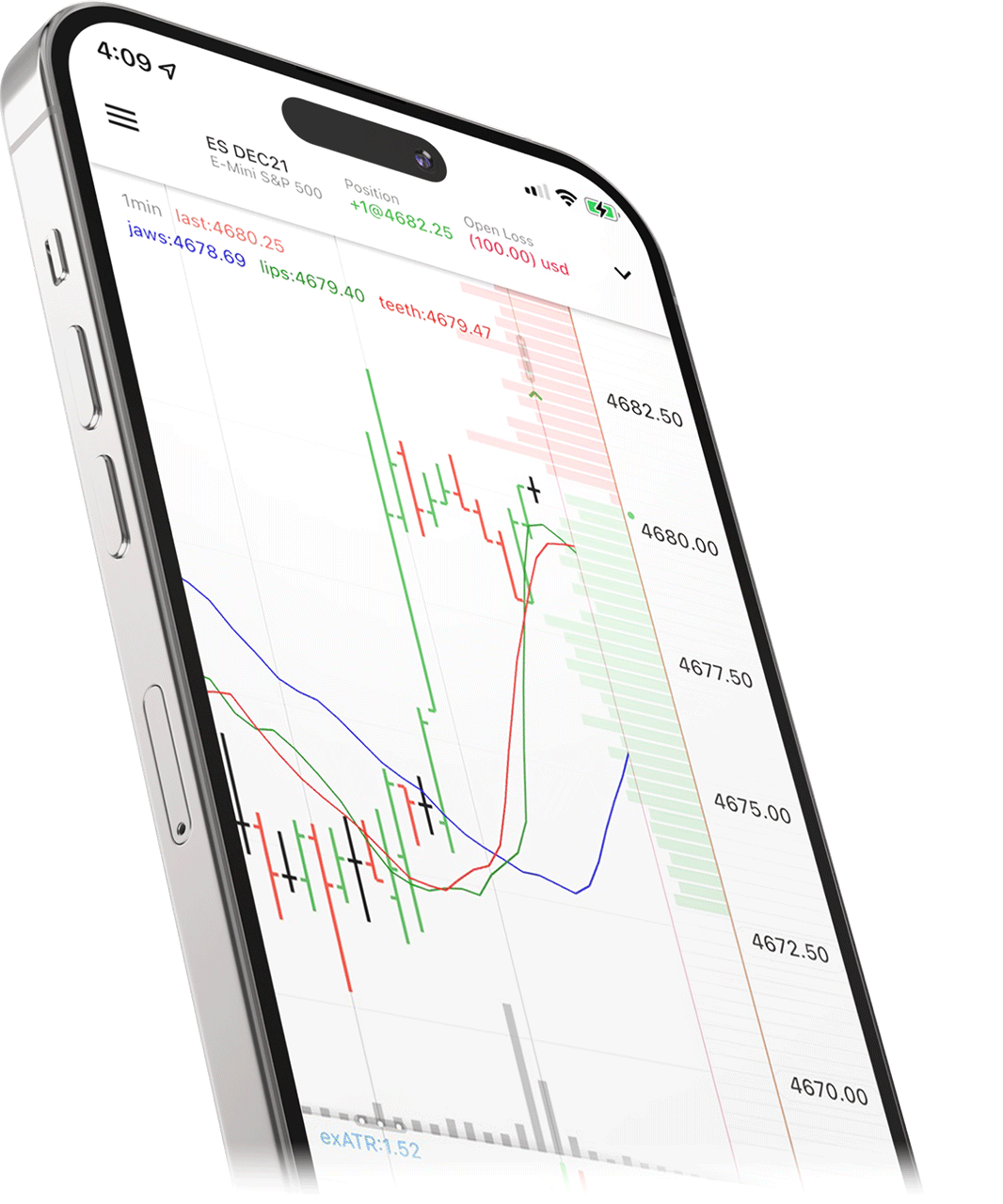

Become a Bitcoin Futures Trader Today

Ready to start trading Micro Bitcoin futures? NinjaTrader is here to support you. With an award-winning trading platform and daily premium market commentary with industry pros, NinjaTrader equips you with the tools you need to embark on your futures trading journey.