To trade and analyze any futures market effectively, traders need to have a clear understanding of the basic fundamental principles of that market. When trading gold futures, it’s important to answer the following questions and adapt them to your general futures trading:

- What can drive the price of gold futures?

- What is the historical seasonal pattern of gold futures?

- What are the intermarket relationships with gold futures?

- How are large gold futures traders positioned?

Whether you’re a short-term trader who’s in and out of the market multiple times a day or a longer-term trader holding positions for days or weeks, there are several fundamental, economic, and technical analysis concepts related to trading gold you need to understand. Having a conceptual understanding of these fundamentals can help you become a more well-rounded trader and to make more informed trading decisions.

In this article, we’ll cover the analysis of gold futures and explore what gold is and how it’s used in finance, jewelry-making, and industrial and manufacturing processes.

How Is Gold Used in the Economy?

Around 50% of all gold produced in the world is used in the creation of jewelry. The top three countries that produce and purchase gold jewelry are China, India, and the United States. About another 30% of world gold production is used for investment storage by individuals and central banks. Gold is held by most central banks around the world to help guarantee the stability of their currency, which is why gold is vital to the world’s financial markets. The remaining 20% of gold production is used for industrial and manufacturing purposes.

What Can Affect the Price of Gold Futures?

We live in an interconnected world where geopolitical and geoeconomic factors like international conflicts, political instability, and other types of negative economic news can create uncertainty, which can drive investors to purchase gold as a flight to safety. Conversely, when the international economic environment is stable and growing, the news-driven demand for gold can decrease, which can lower prices. These types of geopolitical pricing factors generally play out over days, weeks and months. (Figure 1)

Figure 1: Blue line = Weekly gold chart from 2010 to 2023 with 52-week simple moving average, showing the long-term price fluctuation of gold driven by market fundamentals, economic news, and geopolitical events.

Supply and Demand Dynamics of Gold

Supply and demand dynamics are key fundamental factors in the price of gold and are affected by a variety of unique factors.

- Supply: One of the primary factors affecting the amount of gold available on the market is the amount of mining produced by mining companies. Gold mining production is often influenced by the price of gold itself; when gold prices rise, mining becomes more profitable and can increase production rates, which can increase supply. Local political issues, labor strikes, and natural disasters can slow production in some areas, which can decrease supply. Advancements in mining technology, along with an increase in gold recycling, have been adding to gold supplies consistently.

- Demand: Often used as a safe haven, gold prices can rise when there is a perception of economic uncertainty or political turmoil, as investors buy gold to protect their wealth. Central banks around the world use gold to diversify their holdings and for financial security. Demand for gold is often influenced by central bank policy changes as they add to gold reserves. In countries like China and India, cultural or seasonal factors can also increase the demand for jewelry-making. To a lesser extent, the use of gold in industrial and manufacturing processes, based on economic conditions, can also affect the demand for gold.

You can track the supply and demand of gold in the US and around the world through the US Geological Survey (USGS).

How Interest Rates and Currency Exchange Rates Affect Gold Futures

Gold prices can be sensitive to interest rates and currency exchange rates.

- Interest rates: As interest rates rise, gold prices may decrease. Higher interest rates may lead people to diversify investments into bonds and fixed income, which are more attractive than a non-income-bearing asset like gold, affecting its demand. However, this is not always the case, as interest rates should be considered alongside market sentiment. For example, when rising interest rates are used as a tool to battle inflation, gold can still rise in price if traders feel higher interest rates are only temporary. Note that higher interest rates can also often lead to strengthening the US dollar.

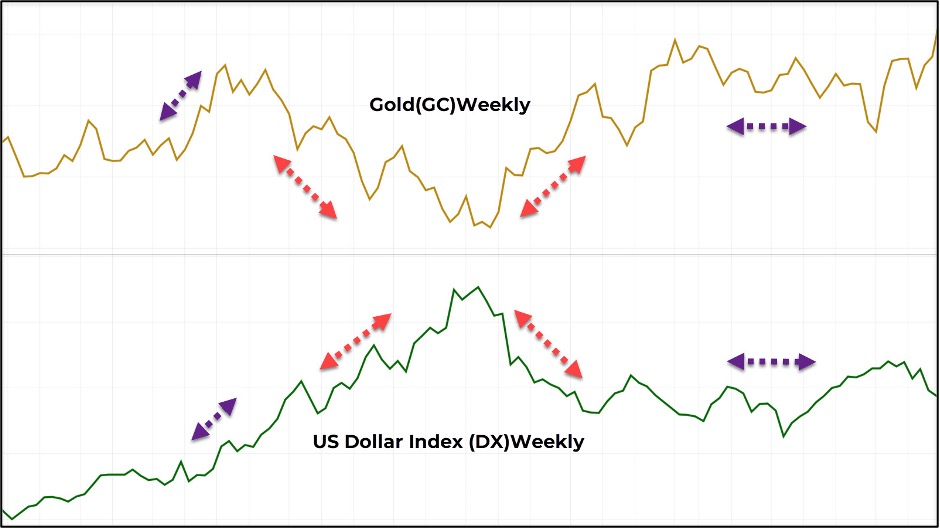

- US Dollar Index: Since gold is transacted and traded in US dollars, a stronger US dollar can lead to a fall in the price of gold due to less demand. Correspondingly, a weaker US dollar can make other foreign currencies relatively more valuable, which can increase the demand for gold. The following chart shows the oppositely correlated relationship between the US Dollar Index futures and gold futures. Notice how the two charts move in the opposite direction from each other. (Figure 2)

Figure 2: Shows the correlation of gold futures to the US Dollar Index futures.

Orange arrows = Opposite correlation since 2022

Purple arrows = Periods of correlation and non-correlation

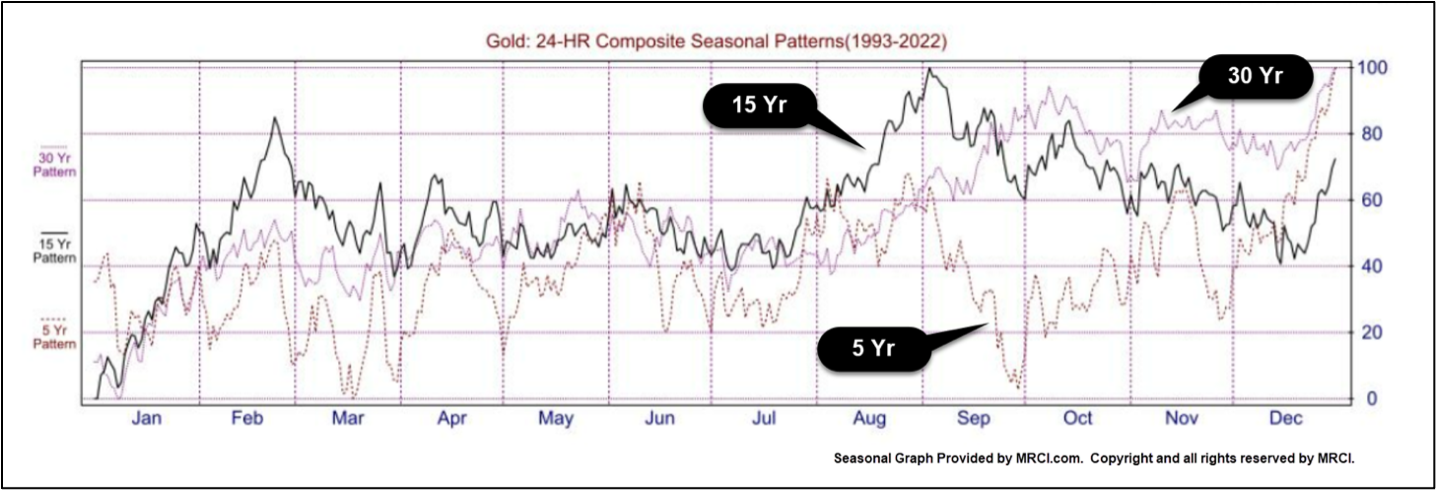

Figure 3: Gold seasonality patterns for 5, 15, and 30 years of historical data.

Seasonality Patterns of Gold Futures

Seasonality is the analysis of historical price patterns throughout the year. The current gold seasonality 15-year pattern (black line) typically sees prices rise in January and February, then move downward in March, then sideways through July, with a sharp rise in August. Prices tend to decline throughout the remainder of the year, except for December, which can see a sharp rise.

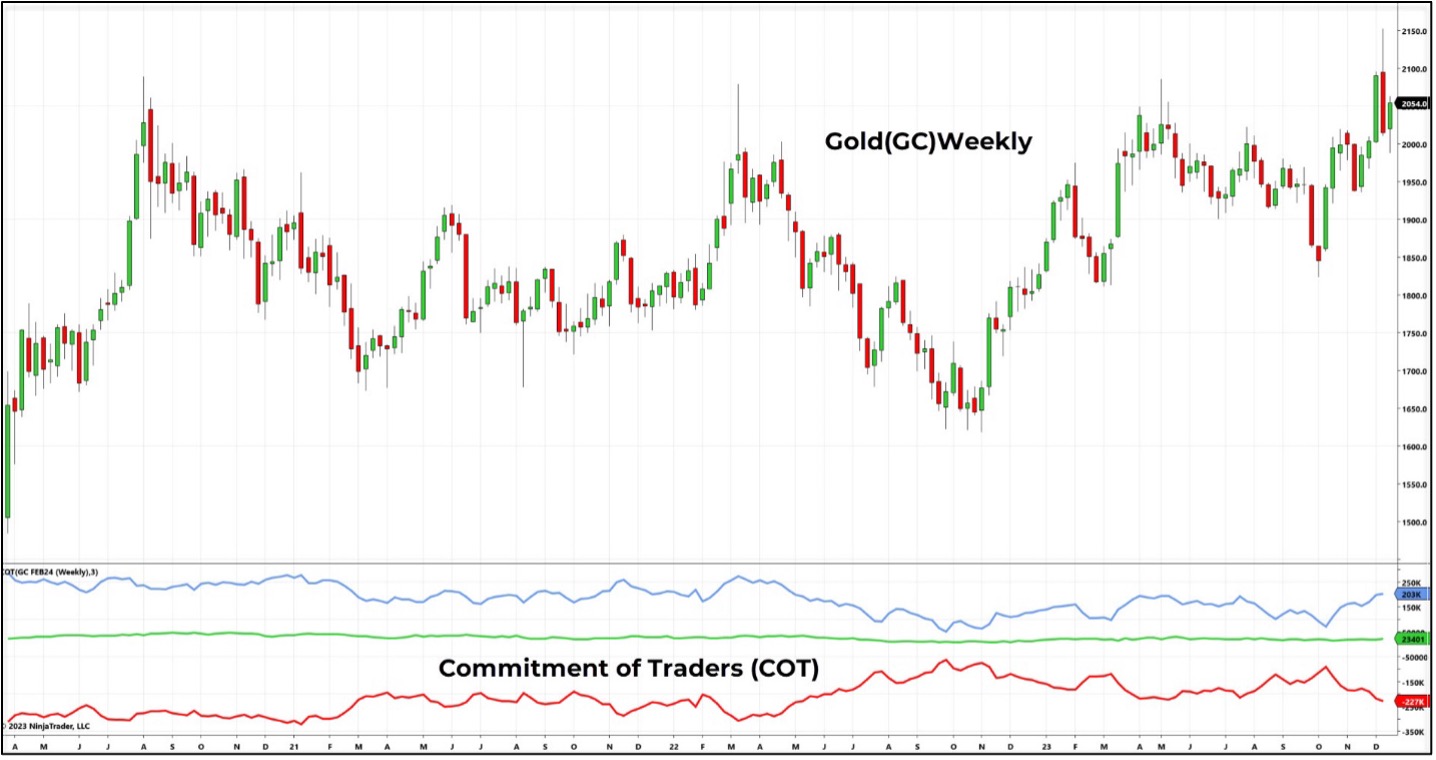

CFTC Commitment of Traders Report for Gold Futures

The Commodity Futures Trading Commission (CFTC) requires all large traders to report their open futures positions on a weekly basis. They then publish those results in the Commitment of Traders (COT) report. Below is the COT indicator for the gold futures available on the NinjaTrader platform. It shows the net position for each group of traders (Figure 4).

Red line = Commercial traders: These traders are typically net short the gold futures

Green line = All other positions

What Affects the Intraday Price of Gold?

The intraday price of gold can fluctuate greatly based on traders’ sentiment and expectations. Daily price movements in gold often result from intermarket relationships, supply and demand dynamics, and economic news reports. Traders looking to speculate on the intraday price movement of gold will generally employ a variety of short-term and long-term historical price charts, using a variety of technical analysis tools to gauge trend direction, support and resistance levels, and increasing or decreasing momentum. (Figure 6)

Continue Your Futures Trading Journey

We’ve covered many of the aspects of analyzing the fundamentals of the gold futures market. Every trader will have their own unique approach to market analysis, combining both fundamental and technical analysis into a trading plan for making more confident trading decisions.

Gold, like many futures markets, is often news-driven, meaning price action can act contrary to your analysis. It’s important to remember when key economic reports and news are about to be released, and either avoid high-volatility environments altogether or protect your orders and positions with aggressive risk management. Determining when to get in and out of a gold position is only part of a comprehensive trading plan that includes trade sizing, risk management, and setting goals and objectives.

Unlock Free Exclusive Training to Level Up Your Fundamental Analysis Skills

Explore the foundational concepts of fundamental and technical analysis with our free multi-video trading course “Technical Analysis Made Easy.” Learn how to analyze and anticipate market movements using market prices, volume data, and more. To access this and other exclusive on-demand courses and educational content, sign up for your free NinjaTrader account today.

Plus, watch our daily livestream events as we prepare, analyze, and trade futures markets in real time.