Coverage for the week of June 12th – June 16th: In this week’s coverage, we examine bullish trends in the Russell 2000, Euro FX and Copper futures, and the consolidating trend in Micro Bitcoin futures. We also examine the economic report releases for the upcoming week.

June E-Mini Russell 2000 Future Daily Chart

The June E-Mini Russell 2000 future extended the bullish trend, breaking through the Ichimoku cloud. This trend stalled before achieving the 61% Fibonacci retracement level (1905) as determined by the downtrend that started in early February and culminated with the low on March 24th. The end-of-week pullback brought the price of the Russell below the 50% Fib retracement of 1866. RSI is still up on the higher end at 61, though failing to get to the overbought level of 70 on what looks like a steep uptrend could mean weakness in the Russell. The MACD, while positive and above its signal line (bullish indications), could show early weakening as the histogram is turning down back toward the zero line. Should the pull back continue, 1827 – 1830 could be support as the top of the Ichimoku cloud, 200-day moving average and 38% Fib retracement are in that area. Resistance to an uptrend might be found at 1905 (61% Fib level).

June Micro Bitcoin Future Daily Chart

June Micro Bitcoin lost some ground last week, in accordance with the downward trend channel established since the recent highs in mid-April. After higher volatility at the beginning of the week brought bitcoin down to the 38% Fibonacci retracement level (as defined by the low in November 2022 to the high on April 14th, bulls and bears alternated daily control, though still closing in the top third of the range of the trend channel. MACD and RSI both have neutral readings, with a slightly bearish trend in both indicators. Bitcoin has more upside resistance, with the top of the trend channel (~27500) and the 50-day moving average occurring near the 23% Fib retracement level (~27750). The bottom of the Ichimoku cloud (25850) and 38% Fib level (25390) could act as support.

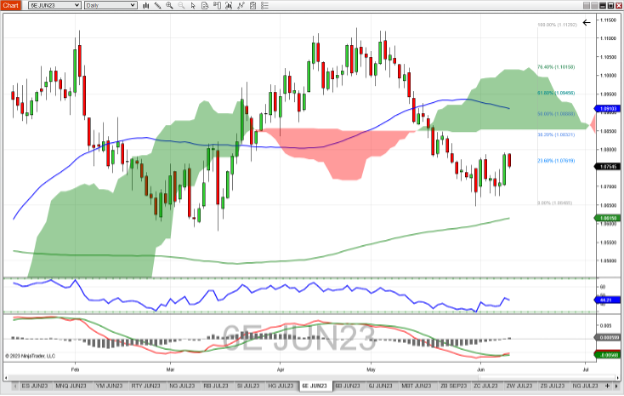

June Euro FX Future Daily Chart

The June Euro FX Future made a strong bid on Thursday to finish the week positive, and Friday’s trading could not undo that outcome, though it did push price below the 23% Fibonacci retracement level found by connecting the high on April 26th to the low on May 31st. The MACD gave a bullish crossing signal on Thursday, which stayed bullish despite Friday’s pullback. RSI is trending in line with price. If price continues the uptrend, resistance might exist at the 38% retracement level (1.0832) and the bottom of the Ichimoku cloud (1.0855). Support might be found at recent lows at 1.0675.

July Copper Future Daily Chart

July Copper continued the bullish trend that began May 25th, testing the 200-day moving average twice before failing to close above it. The 38% Fibonacci retracement level of 3.798 (as defined by the high on April 14th and the low on May 25th) also held as resistance, with copper failing to close above last week. The RSI at 51 is in a neutral range, though it is trending in line with the price chart. The MACD study gave a bullish indication on May 31st, though the MACD line has yet to turn positive. Should the trend stay bullish, price may encounter resistance at the 50-day moving average (~3.85) and the 50% Fib retracement level (3.867). Support could be found at the 23% Fib retracement level (3.701) should sellers continue to push this market down.

Economic Reports for the week of June 12th – June 16th

Commentary: Fed announcement week begins quietly with the USDA putting out a couple weekly agriculture reports, and the U.S. Treasury putting forth their monthly budget report.

The FOMC meeting begins Tuesday morning, and just 30 minutes after that, Consumer Price Index (CPI) arrives, which could give insight into the Fed’s decision which arrives Wednesday at 2 PM ET.

Also on Wednesday, Purchasers Price Index (PPI) in the morning helps to fill in the inflation picture, in anticipation of the Fed decision. The press conference at 2:30 PM ET with Chair Jerome Powell could also inject volatility into the market.

As it is a press conference, market moves can occur at any time during Powell’s address. Several reports drop on Thursday at 8:30 AM ET, including Jobless Claims, Philly Fed Manufacturing and Empire State Manufacturing. Friday, Consumer Sentiment could be a market mover—don’t expect Fed speakers that day as the blackout around an FOMC meeting is still in effect.

| Date | Economic Reports |

|---|---|

| Monday, June 12th | 11:00 AM ET: Export Inspections 2:00 PM ET: Treasury Statement 4:00 PM ET: Crop Progress |

| Tuesday, June 13th | 6:00 AM ET: NFIB Small Business Optimism Index 8:00 AM ET: FOMC Meeting Begins 8:30 AM ET: CPI*** 4:30 PM ET: API Weekly Oil Stocks |

| Wednesday, June 14th | 7:00 AM ET: MBA Mortgage Applications 8:30 AM ET: PPI-Final Demand*** 10:00 AM ET: Atlanta Fed Business Inflation Expectations* 10:30 AM ET: EIA Petroleum Status Report* 2:00 PM ET: FOMC Announcement*** 2:30 PM ET: Fed Chair Press Conference*** |

| Thursday, June 15th | 8:30 AM ET: Jobless Claims*** 8:30 AM ET: Philadelphia Fed Manufacturing Index 8:30 AM ET: Empire State Manufacturing Index 8:30 AM ET: Export Sales 8:30 AM ET: Import and Export Prices 8:30 AM ET: Retail Sales 9:15 AM ET: Industrial Production 10:00 AM ET: Business Inventories 10:30 AM ET: EIA Natural Gas Report* 4:00 PM ET: Treasury International Capital 4:30 PM ET: Fed Balance Sheet |

| Friday, June 16th | 10:00 AM ET: Consumer Sentiment @UMichResearch* 1:00 PM ET: Baker Hughes Rig Count |

*** Market Moving Indicators

* Merit Extra Attention

Get Started with NinjaTrader

NinjaTrader supports more than 800,000 traders worldwide with a powerful and user-friendly trading platform, discount futures brokerage and world-class support. NinjaTrader is always free to use for advanced charting and strategy backtesting through an immersive trading simulator.

Download NinjaTrader’s award-winning trading platform and get started with a free trading demo with real-time market data today!