Micro E-mini S&P 500 futures offer exposure to Standard & Poor’s 500 Index in a contract 1/10th the size of standard E-mini S&P 500 futures. The benchmark S&P index is comprised of 500 large-capitalization companies and is regarded as the best metric of large-cap American equities.

Launched in May of 2019 by the CME Group, Micro E-mini S&P 500 futures were introduced to offer lower barriers to entry for futures traders wishing to participate in US equity markets. This micro-sized contract mimics the full-size E-mini S&P 500 contract and the charts are nearly indistinguishable.

Why Trade Micro E-mini S&P 500 Futures?

Micro E-mini S&P 500 futures (MES) require less of a financial commitment than full size E-minis. Therefore, the MES is an ideal instrument for those who wish to gain exposure to the S&P 500 index with less capital.

Additionally, while only being able to trade one contract of ES futures, a trader with the same account balance has the flexibility of scaling in & out of an MES position with multiple contracts.

MES futures offer investors both long and short opportunities to speculate the S&P 500. Micro equity futures empower traders to access American stock markets without a large financial burden or margin requirement.

Micro E-mini S&P 500 futures also trade virtually around the clock electronically and attract traders from across the globe.

Micro E-mini S&P 500 (MES) Futures Contract Specs:

- Exchange: Chicago Mercantile Exchange (CME)

- Class: Futures

- Trading Symbol: MES

- Contract Size: $5 x S&P 500 Index

- Pricing Unit: U.S. Dollars

- Tick Size: 0.25

- Tick Value: $1.25

- Point Value: 1 = $5

- Intraday Margin: $50

- Contract Months: March, June, September & December

- Trading Hours: Sunday to Friday 6:00 pm – 5:00 pm ET

- Position Limit: 100 contracts

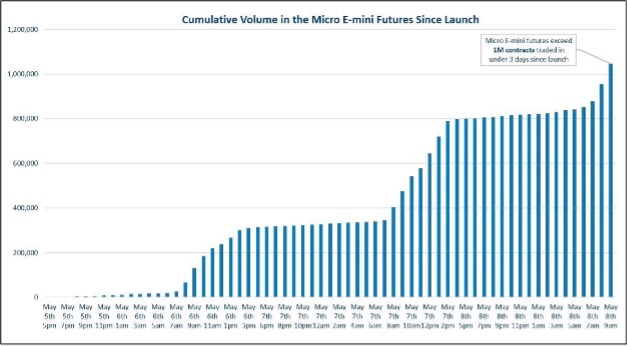

A Well-Received Offering

Gaining instant popularity, Micro E-mini futures volume exceeded 1 million contracts traded in less than 3 full days of trading. The chart below from the CME Group shows hourly Micro E-mini volume from their initial launch on the evening of May 5th 2019 to the morning of May 8th.

NinjaTrader supports over 500,000 traders across the globe with a powerful trading platform featuring 100+ technical trading indicators and award-winning brokerage services.

Get started with NinjaTrader & try SIM trading Micro E-mini futures with a free trading demo! NinjaTrader is always free to use for advanced charting, backtesting and trade simulation.