A stop order, or stop-market order, is a basic order type which issues a market order once a specified price has been reached. This price level is known as the stop price, and when it is touched or surpassed, the stop order becomes a market order.

Stop orders provide a greater probability of achieving a trade at a predetermined entry or exit price. In other words, stop orders are not used solely for exiting positions and can be beneficial for entries as well. When entering a position, traders use stop orders to determine where a market order should be triggered. Conversely, traders also use stop orders for exiting trades to help limit losses or help hold onto profits.

Buy Stop Order vs Sell Stop Order

A buy stop order must be entered above the current market price, and a sell stop order must be entered below the current market price. If the stop price is not touched by the market’s current value, no market order will be issued. Once the stop price is touched, a market order will be issued and filled at the best possible price at the time.

Advantage of Stop Orders

Stop orders provide traders with the ability to specify a price where the order will be triggered. Once the market reaches this stop price, the order then activates and will execute as a market order.

Since market orders will always be filled at the best possible price, a trader can effectively get out of a losing trade using a stop-market order.

Disadvantage of Stop Orders

Although stop-market orders will always be filled provided the stop price is hit, the resulting market orders do not guarantee price and therefore do not allow any precision in order entry.

While the order will be filled at the best available price at the time, the execution price may be different than the last quoted price. In fast moving markets, the execution price could be much different than what the trader expected.

Examples of Stop Orders

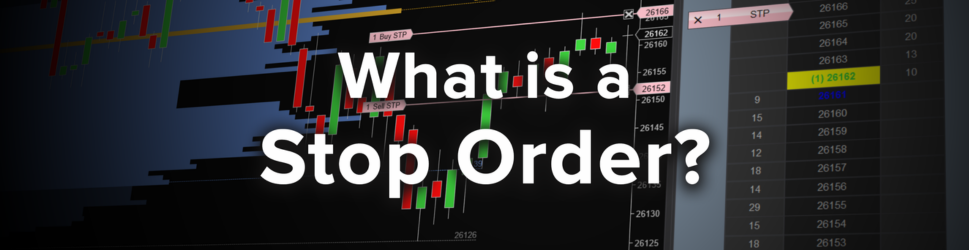

From the E-mini Dow (YM) chart above, with the market currently trading at 26140, the buy stop order at 26164 would require the market to move up to 26164 to trigger and would then issue a buy market order.

On the other hand, the sell stop order at 26121 would require the market to move down to 26121 to trigger and would then issue a sell market order.

Learn more about basic order types in this quick video overview:

The award-winning NinjaTrader platform supports both basic and advanced order types. Additionally, NinjaTrader is always free for advanced charting, strategy backtesting and trade simulation. Get started with our free trading simulator and explore the market possibilities!