Coverage for the week of April 24th - April 28th: In this week’s coverage, we examine the bullish trend exhibited by the June E-Mini S&P 500 future, gasoline (RB) futures, weakness shown by the June Japanese Yen future and an update on the May Silver future. Finally, we will provide an update on companies reporting earnings for the week, as well as economic report releases to expect in the coming days.

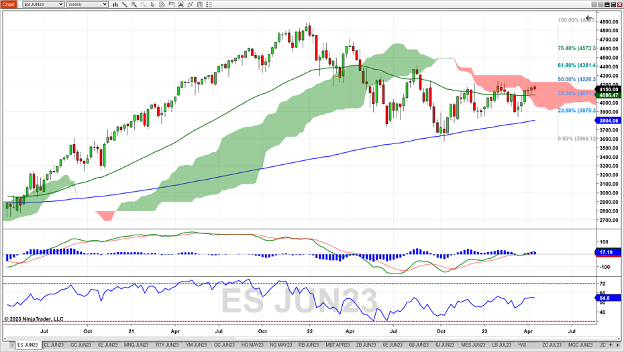

June E-Mini S&P 500 Future Weekly Chart

The June E-Mini S&P 500 future continues to show a bullish bias despite last week’s downturn. Price broke into the Ichimoku cloud at the end of March, coinciding with a break above the 52-week simple moving average. This market failed to test the psychological level of 4200, which was tested in December of last year and in February of this year. The MACD indicators crossed above the zero line and its signal line at that same time, reinforcing the current bullish trend. Should this market continue to the upside, resistance could occur in the 4225 – 4230 area (top of the Ichimoku cloud, 50% Fibonacci retracement of the downtrend starting in January 2022, and ending in October 2022). Support might be found at 4070-4075 (38.2% Fib retracement and the 52-week simple moving average).

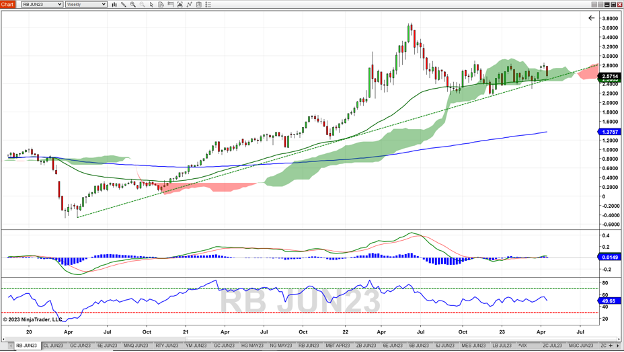

June RBOB Gasoline Future Weekly Chart

Gasoline (RB) futures retraced back into the Ichimoku cloud last week, closing the gap from two weeks earlier. This market has been range-bound between 2.20 and 2.80 since November 2022, spending most of that time in the cloud. A long term supporting trend line from lows in 2020 has been tested recently but still has held. Both the MACD and RSI show no serious trend in place, as they are both at neutral levels (MACD at 0, RSI at 50). If the trend turns bullish, look for 2.75 -2.80as resistance, while support levels might be found at 2.45 – 2.50 (52-week moving average and bottom of the cloud).

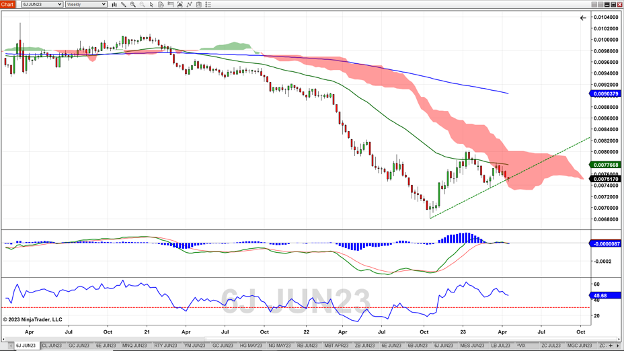

June Japanese Yen Future Weekly Chart

The June Japanese Yen future continued to show weakness off the March test of the 52-week moving average, finding lift at the supportive trend line found by connecting lows in October 2022 and March 2023. The downtrend could continue as it hugs the bottom part of the Ichimoku cloud. Momentum indicators MACD and RSI showing consolidation, with a slight bearish bias in the 45 print in RSI. Should the downtrend continue, look for support at 0.007375 (March low). A turn back up in the yen could find resistance at the0 .007760 area (the 52-week moving average) and 0.008000 (top of the Ichimoku cloud).

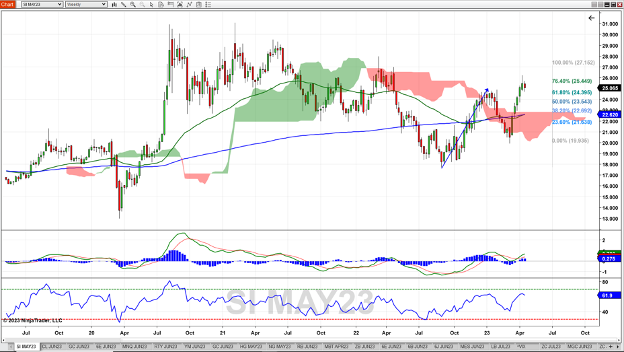

May Silver Future Weekly Chart

The May Silver future showed some pause to the current weekly uptrend, resulting in a bearish harami pattern, where the current bearish candles’ body fits within the previous bullish candle’s body. Price is well above 52-week and 200-week moving averages, and above the Ichimoku cloud, both bullish states. The momentum indicators paint slightly different pictures- the MACD recently crossed above the zero line and its signal line, indicating a change to a bullish trend. RSI is turning down, which is consistent with the recent pause in silver’s uptrend. If the uptrend resumes and can get past the 76.4% Fibonacci extension level of 25.45 (as measured from the previous uptrend from September 2022 to January 2023), look for resistance at 27.15 (100% Fib extension). Should this be the start of a bear trend, look for support at the 22.70 – 22.75 level (38.2% Fib extension level and top of the Ichimoku cloud).

Companies Reporting Earnings April 24th – April 28th

Commentary: 11 companies in the Dow Jones Index report earnings this week, starting with Coca-Cola Monday morning and finishing with Chevron Friday morning. Tech giants Alphabet (Google), Microsoft, and Meta Platforms (Facebook) report after markets on Tuesday and Wednesday. Intel and eBay further the tech picture on Wednesday and Thursday. Boeing, Southwest and American Airlines represent the airline sector – look for their guidance to give insight into the health of the travel industry.

* indicates that this company is in the Dow Jones Index

| Date | Earnings Reports |

|---|---|

| Monday, April 24th | Coca-Cola Company (KO): $0.65 EPS Estimate, $10.80B Revenue Estimate (BMO)* Royal Philips. (PHG): $0.19 EPS Estimate, $3.89B Revenue Estimate (BMO) Whirlpool Corp. (WHR): $2.14 EPS Estimate, $4.48B Revenue Estimate (AMC) |

| Tuesday, April 25th | 3M Company (MMM): $1.60 EPS Estimate, $7.48B Revenue Estimate (BMO)* Archer-Daniels-Midland (ADM): $1.71 EPS Estimate, $24.07B Revenue Estimate (BMO) Dow Chemical Co. (DOW): $0.37 EPS Estimate, $11.35B Revenue Estimate (BMO)* General Electric Co. (GE): $0.13 EPS Estimate, $13.36B Revenue Estimate (BMO) General Motors Corp. (GM): $1.58 EPS Estimate, $38.73B Revenue Estimate (BMO) McDonalds Corp. (MCD): $2.30 EPS Estimate, $5.57B Revenue Estimate (BMO)* PepsiCo, Inc. (PEP): $1.37 EPS Estimate, $17.21B Revenue Estimate (BMO) United Parcel Service, Inc. (UPS): $2.19 EPS Estimate, $23.04B Revenue Estimate (BMO) Verizon Communications (VZ): $1.19 EPS Estimate, $33.63B Revenue Estimate (BMO)* Alphabet Inc. (GOOGL): $1.06 EPS Estimate, $68.85B Revenue Estimate (AMC) Microsoft Corp. (MSFT): $2.22 EPS Estimate, $51.03B Revenue Estimate (AMC)* Universal Health Services, Inc. (UHS): $2.15 EPS Estimate, $3.45B Revenue Estimate (AMC) Visa Inc. (V): $1.97 EPS Estimate, $7.78B Revenue Estimate (AMC)* |

| Wednesday, April 26th | Boeing Co. (BA): ($0.98) EPS Estimate, $17.58B Revenue Estimate (BMO)* Humana, Inc. (HUM): $9.31 EPS Estimate, $26.45B Revenue Estimate (BMO) eBay, Inc. (EBAY): $0.87 EPS Estimate, $2.48B Revenue Estimate (AMC) Meta Platforms, Inc. (META): $1.96 EPS Estimate, $27.61B Revenue Estimate (AMC) |

| Thursday, April 27th | American Airlines Group (AAL): $0.04 EPS Estimate, $12.23B Revenue Estimate (BMO) AstraZeneca PLC (AZN): $0.85 EPS Estimate, $10.75B Revenue Estimate (BMO) Caterpillar, Inc. (CAT): $3.79 EPS Estimate, $15.26B Revenue Estimate (BMO) Merck & Co., Inc. (MRK): $1.37 EPS Estimate, $13.84B Revenue Estimate (BMO) Southwest Airlines Co. (LUV): ($0.21) EPS Estimate, $5.73B Revenue Estimate (BMO) Amgen, Inc. (AMGN): $3.84 EPS Estimate, $6.21B Revenue Estimate (AMC)* Intel Corp. (INTC): ($0.16) EPS Estimate, $11.05B Revenue Estimate (AMC)* T-Mobile US Inc. (TMUS): $1.45 EPS Estimate, $19.86B Revenue Estimate (AMC) |

| Friday, April 28th | Chevron Corp. (CVX): $3.36 EPS Estimate, $49.53B Revenue Estimate (BMO)* Exxon Mobile Corp. (XOM): $2.70 EPS Estimate, $83.11B Revenue Estimate (BMO) |

Economic Reports for the week of April 24th – April 28th

Commentary: This week begins the Federal Reserve speaker blackout, which will last until next week’s FOMC announcement and Fed Reserve Chair Jerome Powell’s comments. Tuesday brings multiple housing reports at 9 and 10 AM ET, followed by the weekly MBA Mortgage Applications report Wednesday morning and Pending Home Sales on Thursday morning. Regional Manufacturing reports from Dallas, Richmond and Kansas City occur throughout the week – which could inform as to how the Fed may view the labor market (and hence guide their interest rate policy). The big numbers drop on Thursday morning at 8:30 am – the first revision of Q1 GDP, and the usual Jobless Claims report. Be sure to be aware and have proper stops if you decide to participate at or before those times.

*** Market Moving Indicators

* Merit Extra Attention

| Date | Economic Reports |

|---|---|

| Monday, April 24th | 8:30 AM ET: Chicago Fed National Activity Index 10:30 AM ET: Dallas Fed Manufacturing Survey 11:00 AM ET: Export Inspections 4:00 PM ET: US: Crop Progress |

| Tuesday, April 25th | 9:00 AM ET: Case-Shiller Home Price Index 9:00 AM ET: FHFA House Price Index 10:00 AM ET: New Home Sales 10:00 AM ET: Consumer Confidence 10:00 AM ET: Richmond Fed Manufacturing Index 1:00 PM ET: Money Supply* 3:00 PM ET: Cold Storage 4:30 PM ET: API Weekly Oil Stocks |

| Wednesday, April 26th | 7:00 AM ET: MBA Mortgage Applications 8:00 AM ET: Bank Reserve Settlement 8:30 AM ET: Durable Goods Orders 8:30 AM ET: International Trade in Goods (Advance) 8:30 AM ET: Wholesale Inventories (Advance) 8:30 AM ET: Retail Inventories (Advance) 10:00 AM ET: State Street Investor Confidence Index 10:30 AM ET: EIA Petroleum Status Report* 11:00 AM ET: Survey of Business Uncertainty |

| Thursday, April 27th | 8:30 AM ET: Export Sales 8:30 AM ET: GDP*** 8:30 AM ET: Jobless Claims*** 10:00 AM ET: Pending Home Sales Index 10:30 AM ET: EIA Natural Gas Report 11:00 AM ET: Kansas City Fed Manufacturing Index 4:30 PM ET: Fed Balance Sheet |

| Friday, April 28th | 8:30 AM ET: Employment Cost Index 8:30 AM ET: Personal Income and Outlays*** 9:45 AM ET: Chicago PMI* 10:00 AM ET: Consumer Sentiment 1:00 PM ET: Baker Hughes Rig Count 3:00 PM ET: Farm Prices |

Get Started with NinjaTrader

NinjaTrader supports more than 800,000 traders worldwide with a powerful and user-friendly trading platform, discount futures brokerage and world-class support. NinjaTrader is always free to use for advanced charting and strategy backtesting through an immersive trading simulator.

Download NinjaTrader’s award-winning trading platform and get started with a free trading demo with real-time market data today!