Orders are the core of electronic trading. As a result, understanding various order types is an important first step in futures trading for beginners.

In this article, the function and significance of three basic order types are outlined:

-

Limit Orders

-

Stop-Market Orders

-

Stop-Limit Orders

Watch this two-minute video for an introduction to these order types:

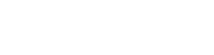

1. Limit Orders

A limit order is executed only when market price satisfies a user defined limit price. Buy-limit orders can be placed below price action, while sell-limit orders are placed above current price.

These orders are used for both entering and exiting trades. For example, a trader can buy into a market when their buy-limit order is hit and use a sell-limit order when price reaches a pre-determined level.

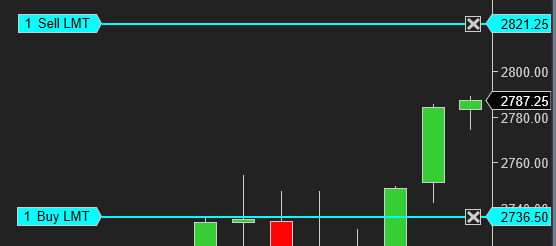

2. Stop-Market Orders

Similar to limit orders, stop-market orders are executed when a defined price is hit by the market. However, buy-stop orders are place ABOVE market price and sell-stop order are place BELOW market price. This is the opposite of limit orders.

Another name for a stop-market order is “Stop Loss” as these orders are often used to protect open positions to tentatively exit a trade as a loss.

Stop-market orders can also be used to enter a trade if a specific price level is breached. This is commonly referred to as a breakout trade. It’s important to note that stop-market orders become market orders once the stop price is fulfilled by the market.

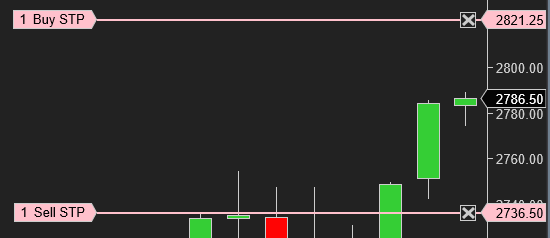

3. Stop-Limit Orders

Stop-limit orders act as a hybrid between stop market orders and limit orders. These orders are executed at a specific price or better after a stop price is reached. This means that a trader must define a stop price as well as the limit value.

Stop-limit orders provide traders with greater control over order entry, but since there is a limit value involved, the orders are not guaranteed to be executed. While this can help traders avoid whip-saw market moves causing what’s known as slippage, it’s important to know these orders are not guaranteed to fill especially when used in exiting a trade.

NinjaTrader’s award winning software provides traders with multiple options for order entry including the Basic Entry, SuperDOM and Chart Trader interfaces. More advanced order types including market if touched (MIT) and One Cancels Other (OCO) can also be valuable tools for traders.

Ready to try it yourself? NinjaTrader is always free to use for advanced charting, strategy development, trade simulation and more. Get started for FREE today.